Ch11 Market Power, Collusion, and Oligopoly¶

Merger¶

horizontal integration¶

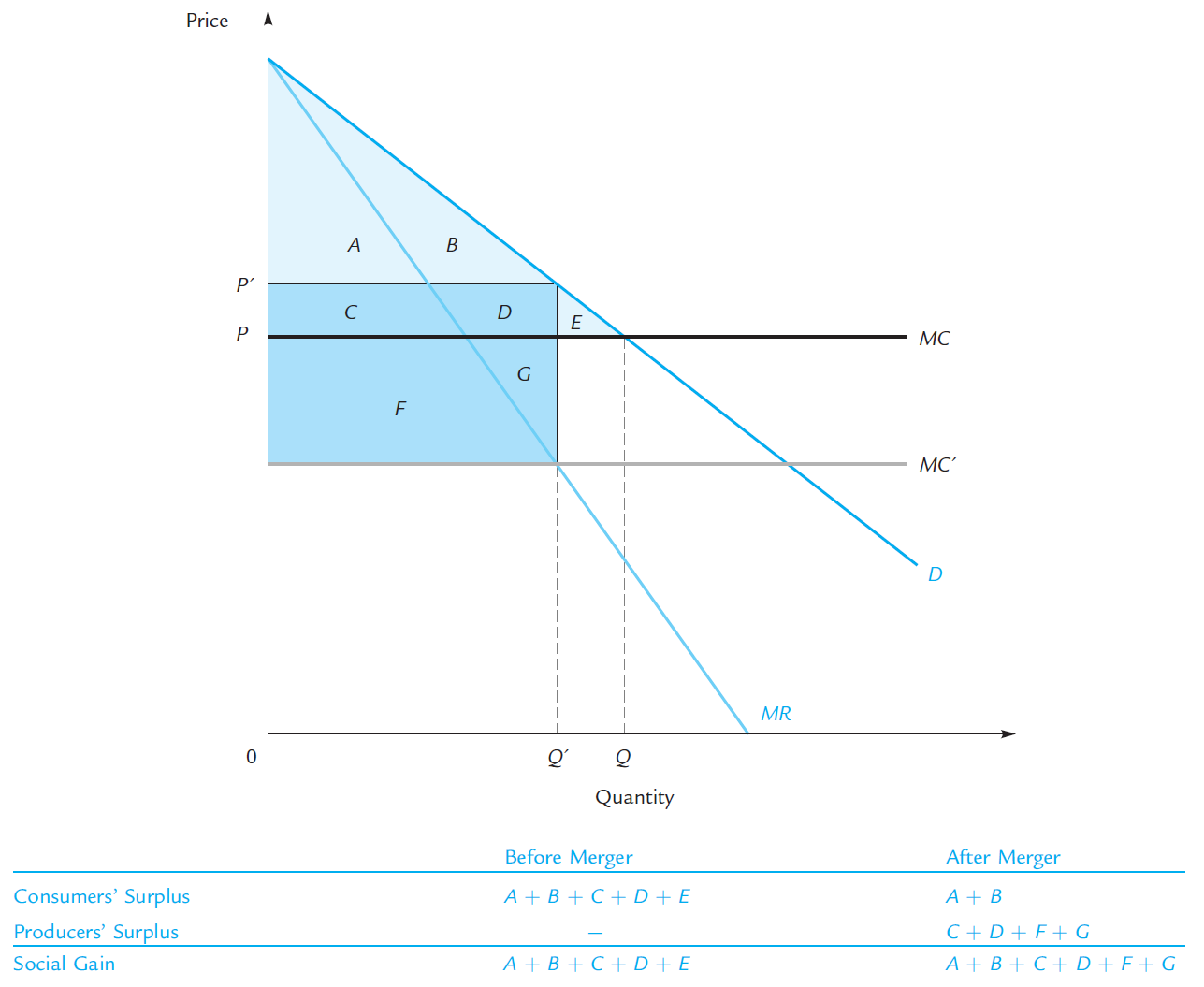

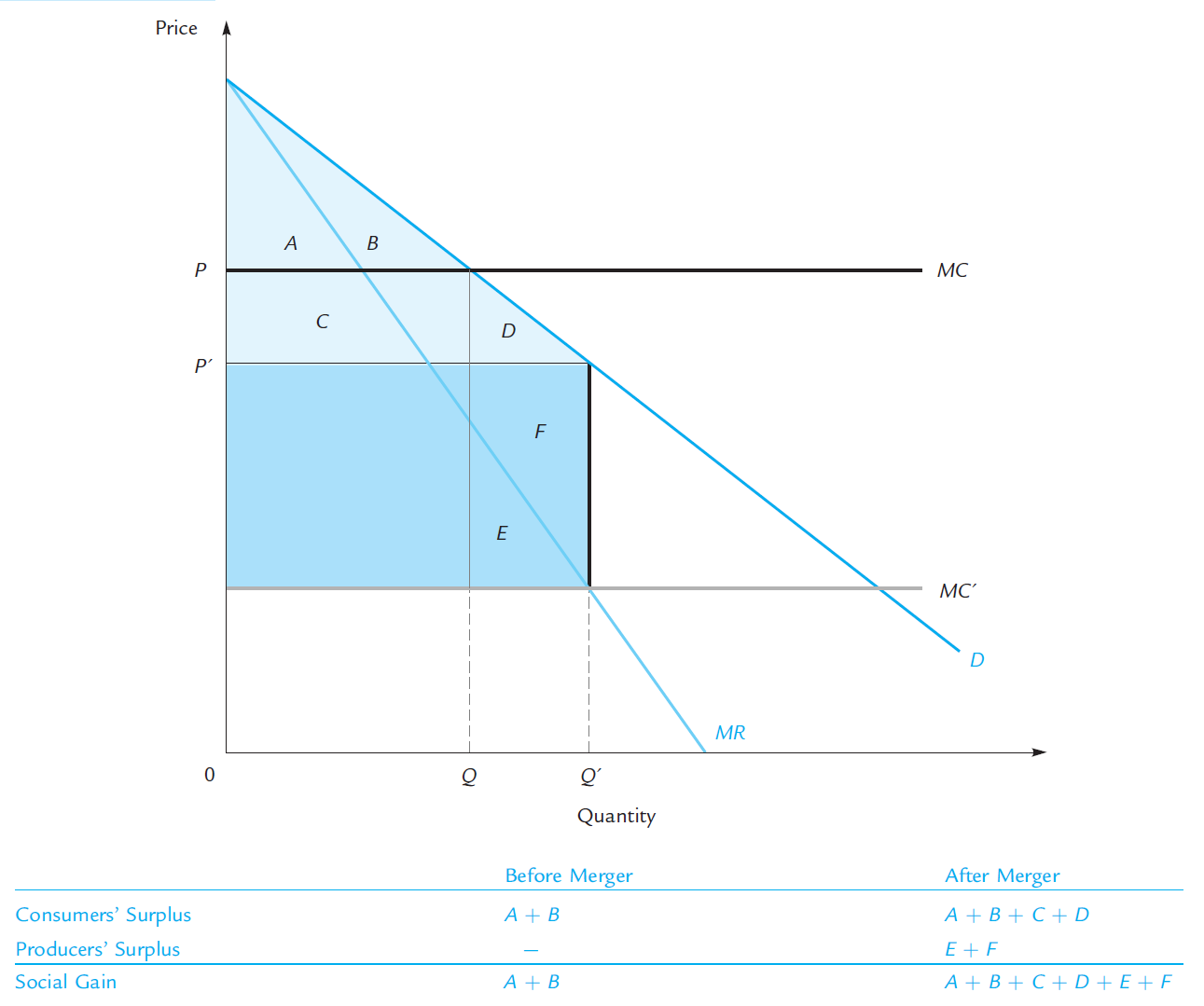

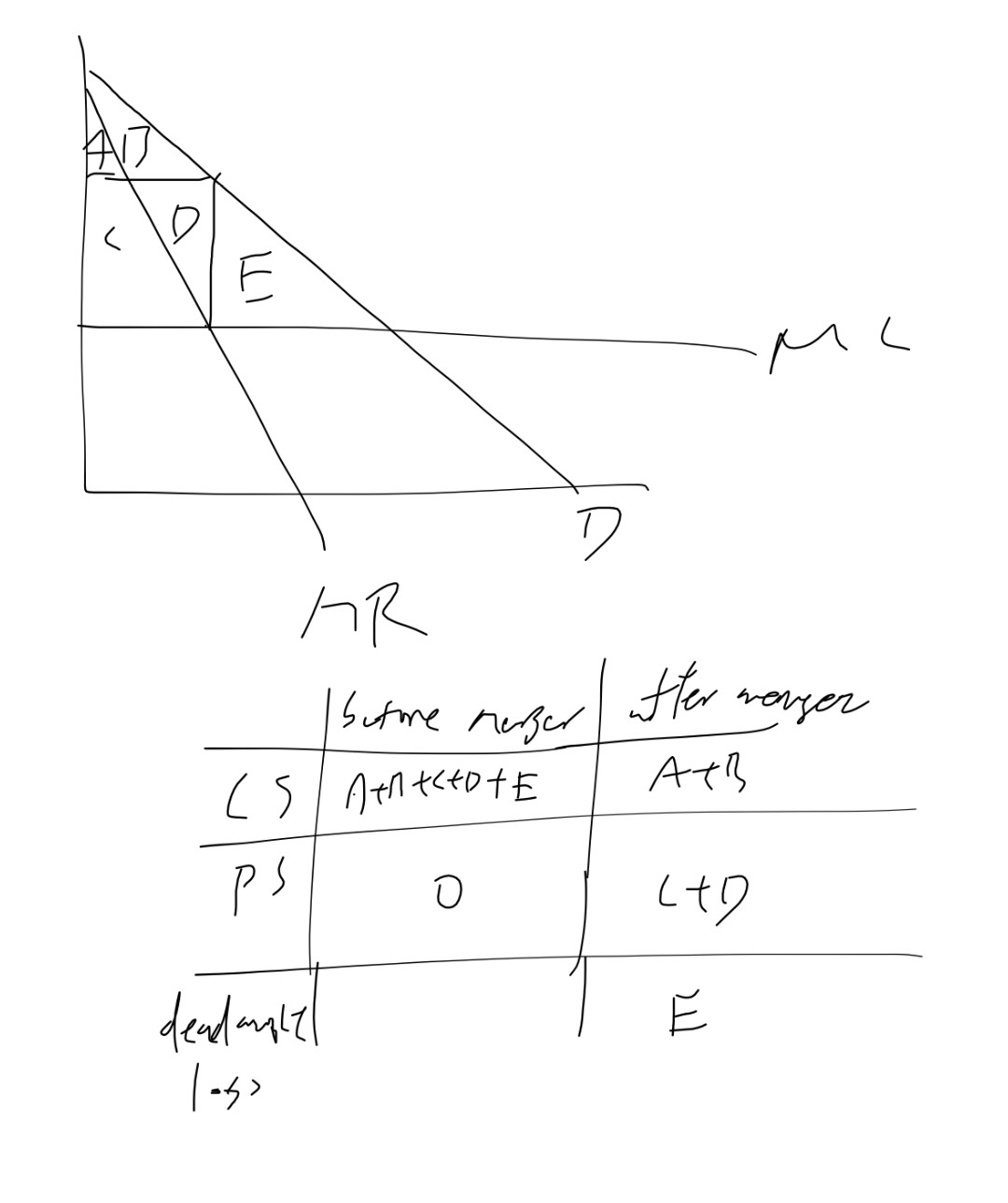

before merger: competitive (to where D=MC)

after merger: MC drops

don't necessarily gain

don't necessarily gain

if MC' << MC

P' lower than before merger

and both consumers & producer gain

if MC' = MC

deadweight loss

deadweight loss

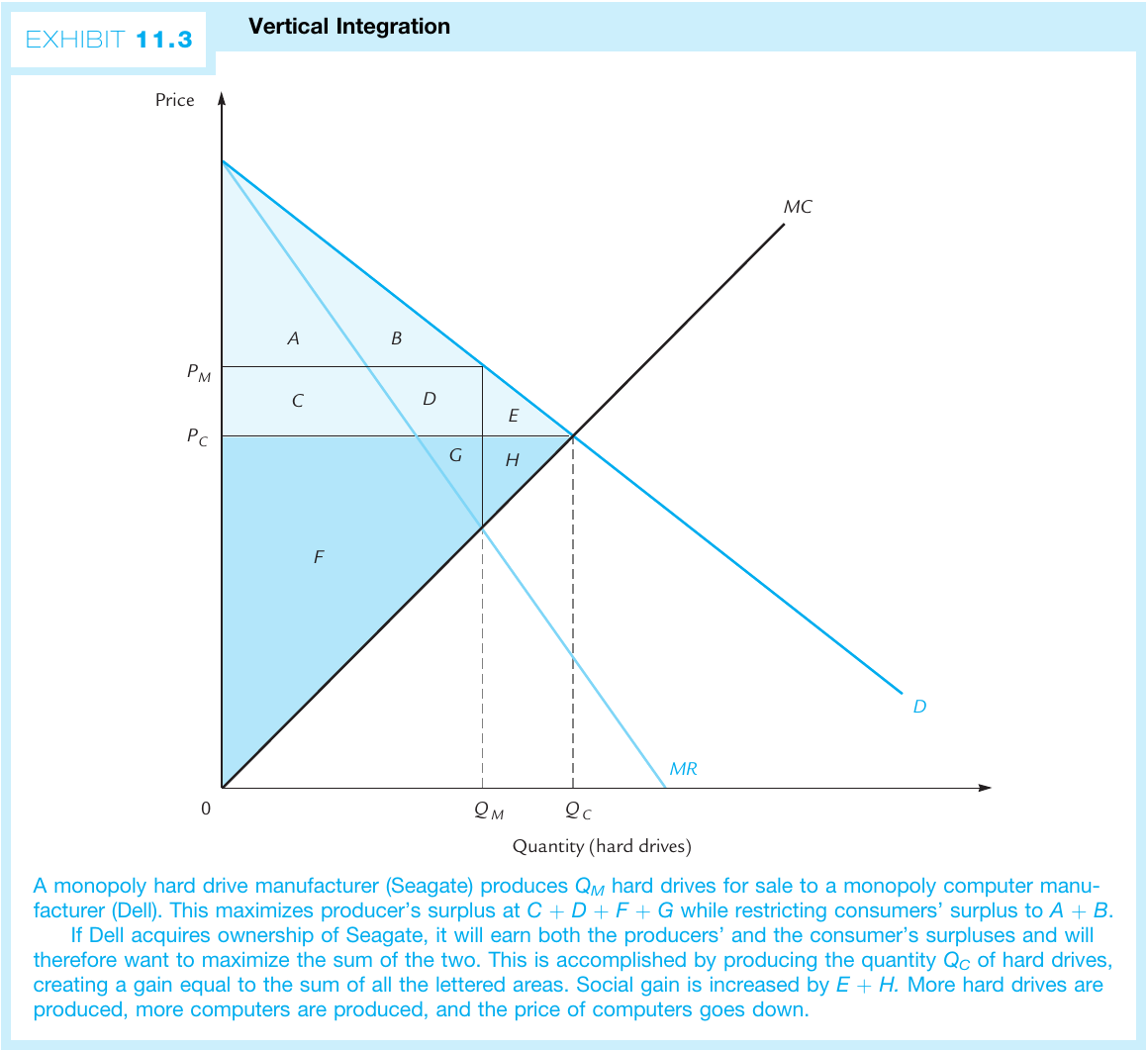

vertical integration¶

Say there's a upstream monopoly and downstream monopoly respectively. Upstream company would sell a monopoly price for downstream company, which is a part of the MC of downstream company. When they merge, Upstream would produces at MC = D, lowering the MC of downstream.

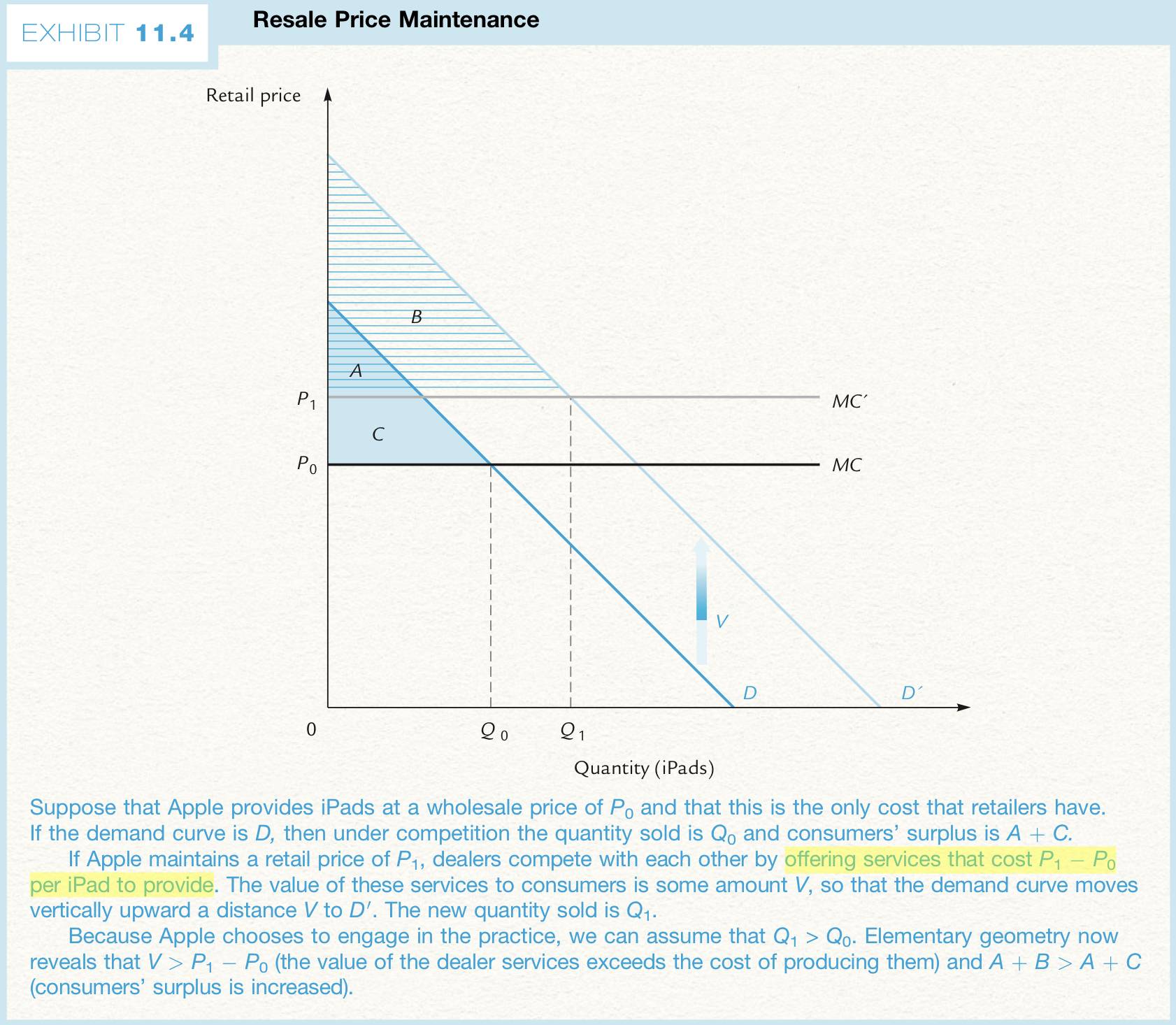

provide service¶

resale price

Oligopoly¶

cartel¶

A group of firms engaged in collusion

will fail due to prison dilemma, unless repeated

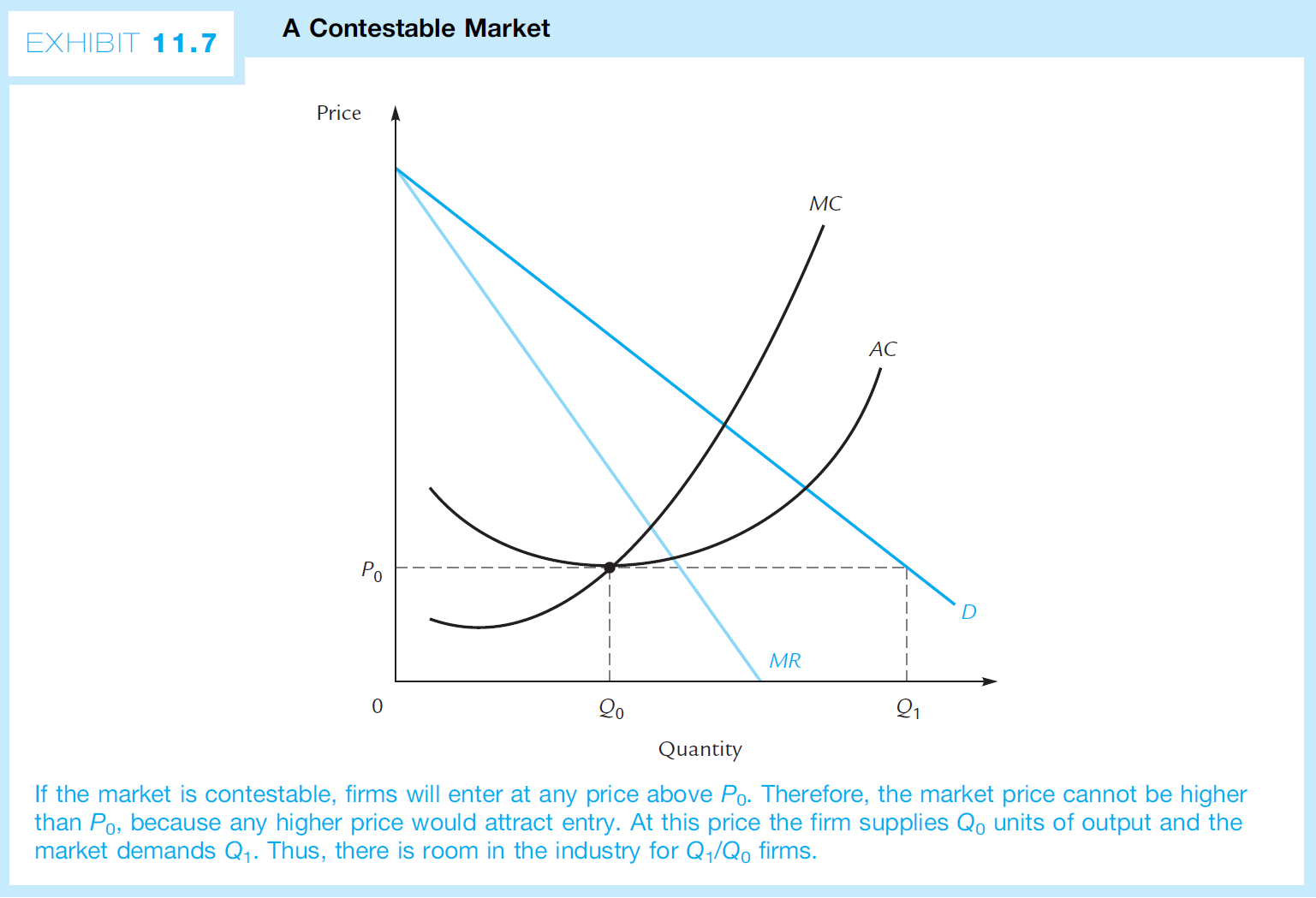

contestable market¶

firm can enter & exit costlessly

P=MC=AC

P=MC=AC

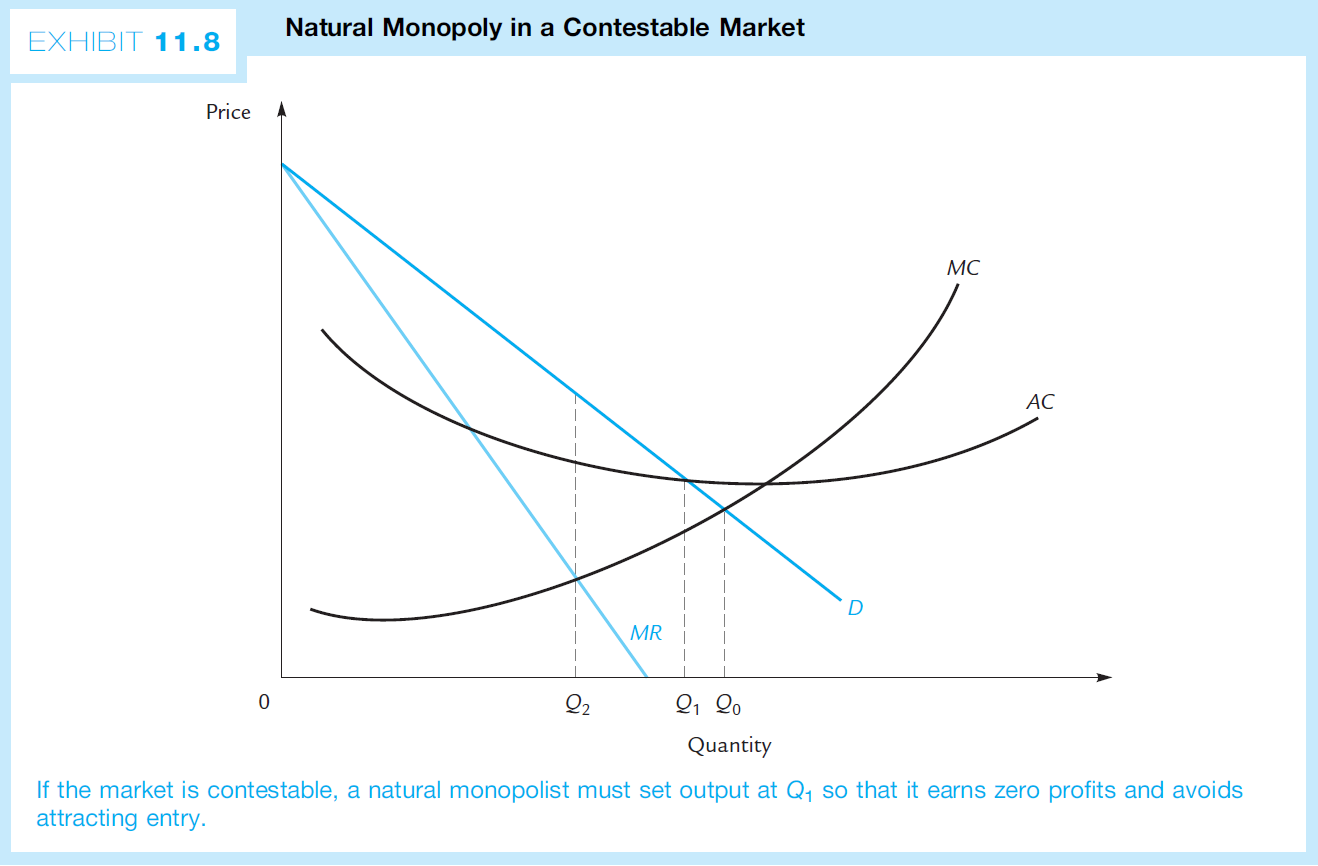

natural monopoly in a contestable market

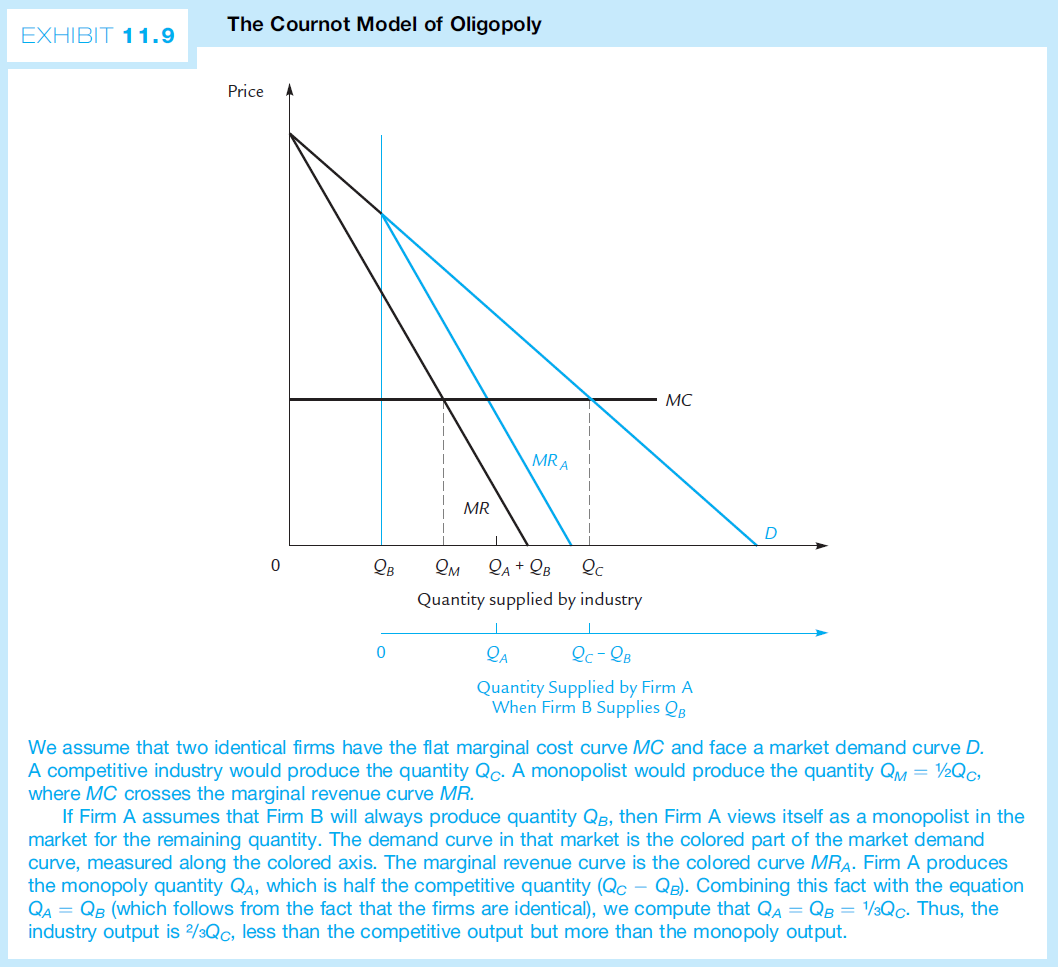

Cournot model¶

Cournot Model

==assumption: the rival has fixed quantity== i.e. take rivals' output as given

Bertrand model¶

==assumption: the rival has fixed price== i.e. take rivals' price as given, and assume the rival won't change it → will undercut its price as long as > MC s.t. it can capture the entire market → repeatedly undercut each's price → ==price = MC = competition price==

about Cournot & Bertrand model¶

if the assumptions fail, which is always the case, the models won't work

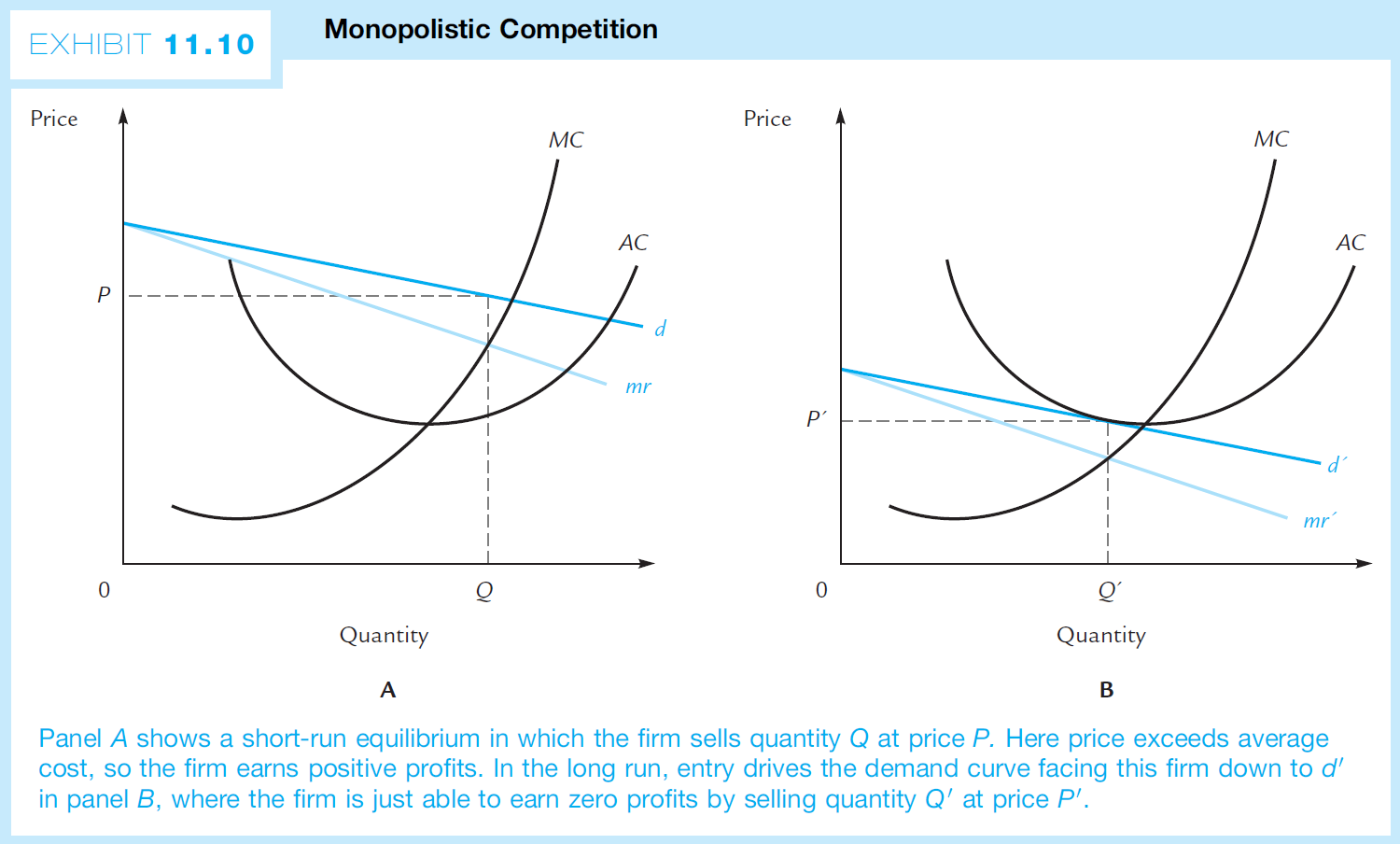

monopolistic competition¶

- monopolistic competition

- producing a product that differs sufficiently from the output of other producers that some consumers will have a distinct preference for it

- basically same products with different branding

- demand very elastic

- Q = where MR = MC

- short run : positive economic profits

- long run : zero economic profits

- TR = TC i.e. P = AC

HW¶

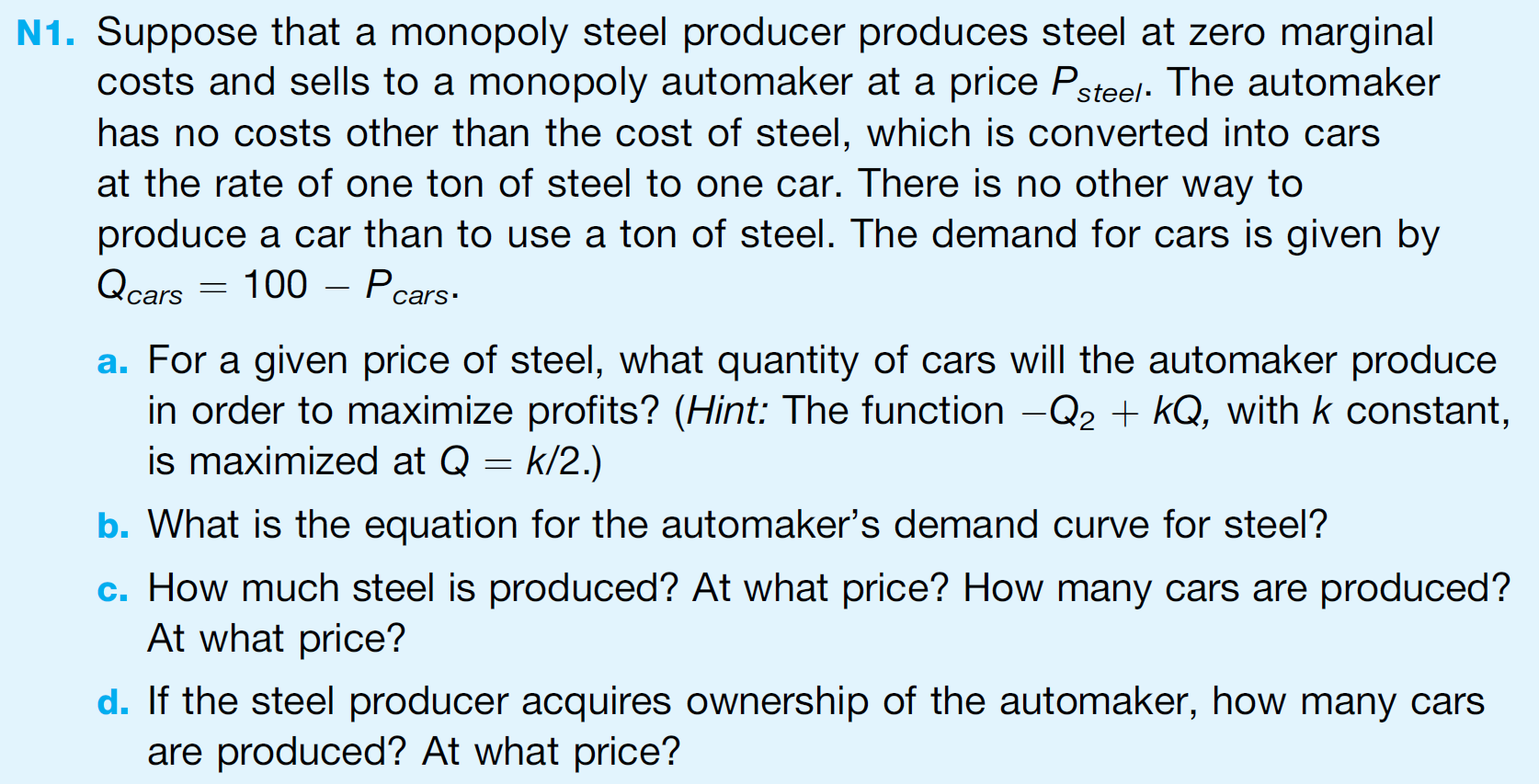

N1¶

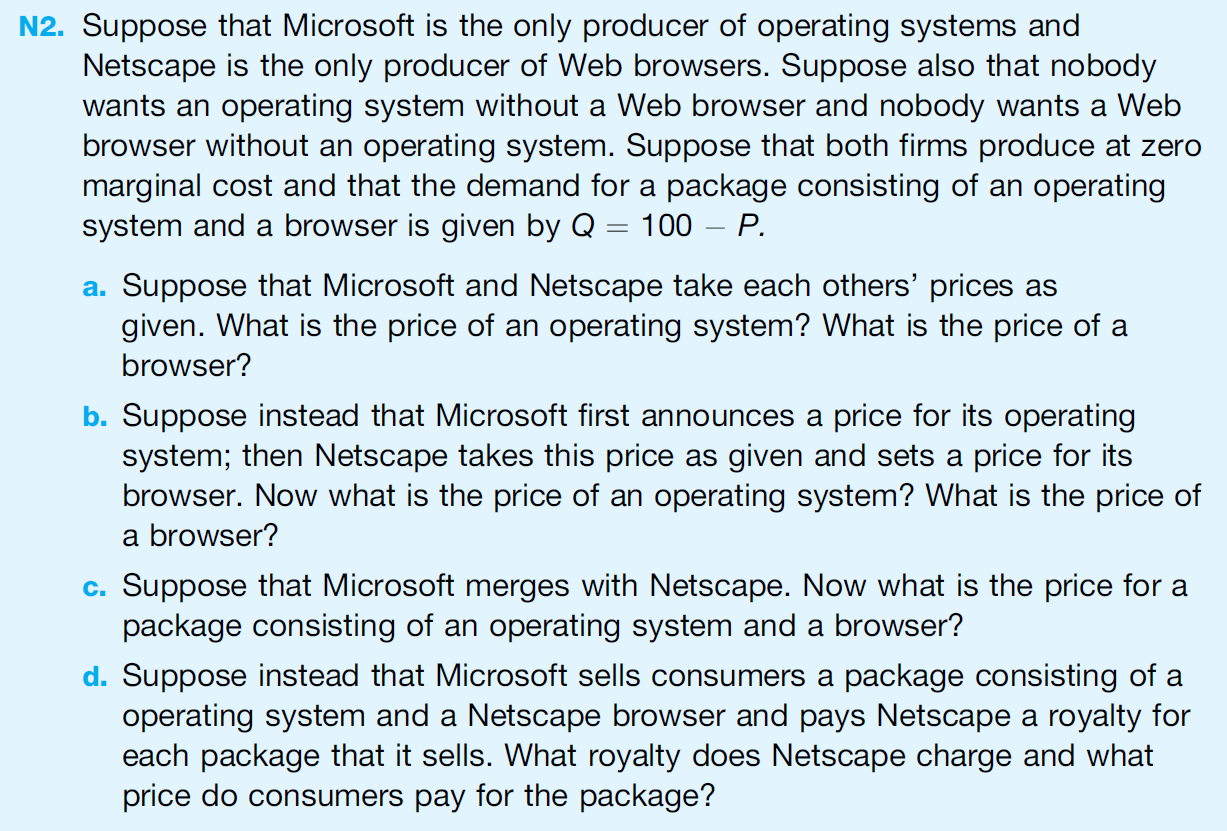

N2¶

N2(b) N 先根據 \(P_M\) 定出 \(P_N\) 定出 Q,M 再根據 Q 定出 \(P_M\)

N2(b) N 先根據 \(P_M\) 定出 \(P_N\) 定出 Q,M 再根據 Q 定出 \(P_M\)

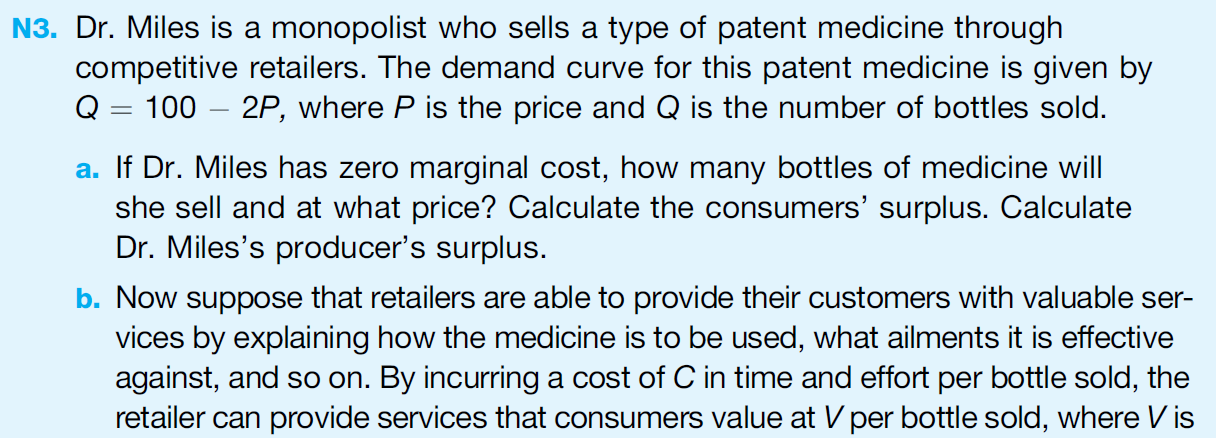

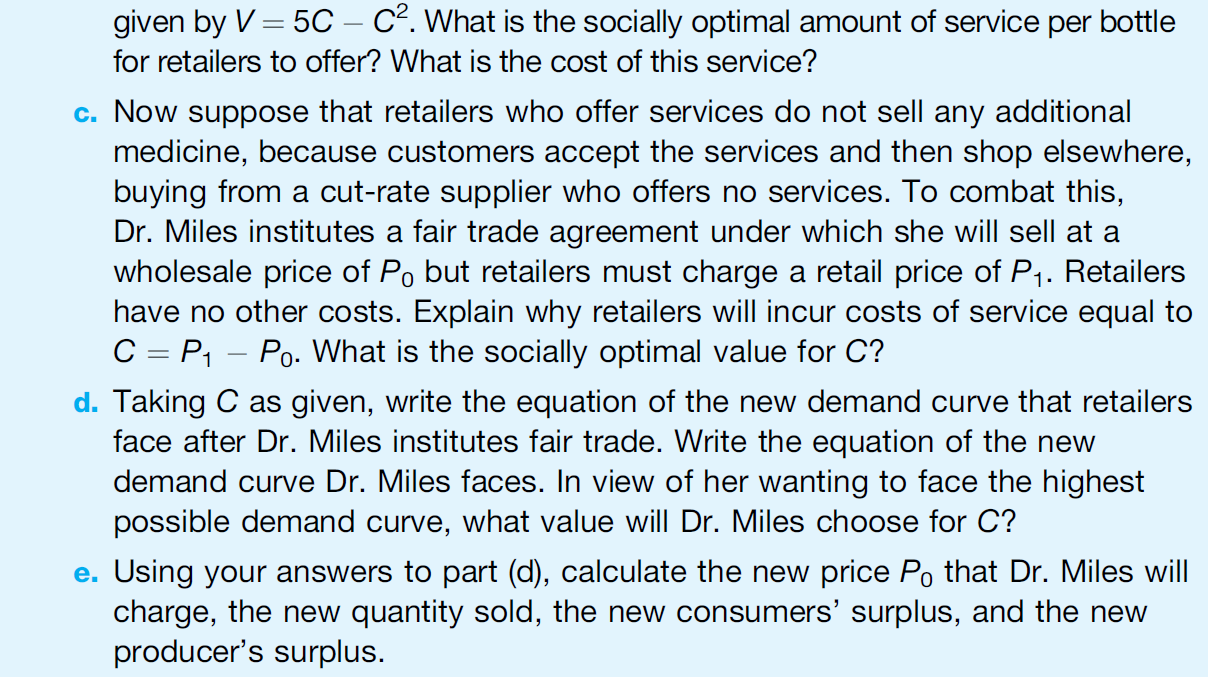

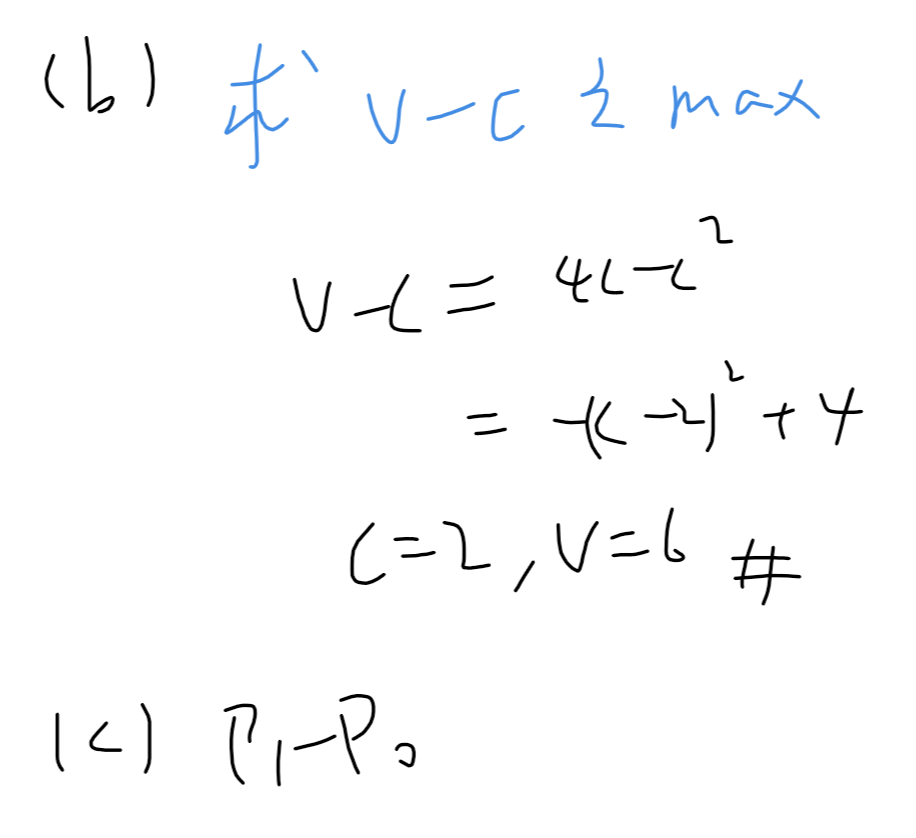

N3¶

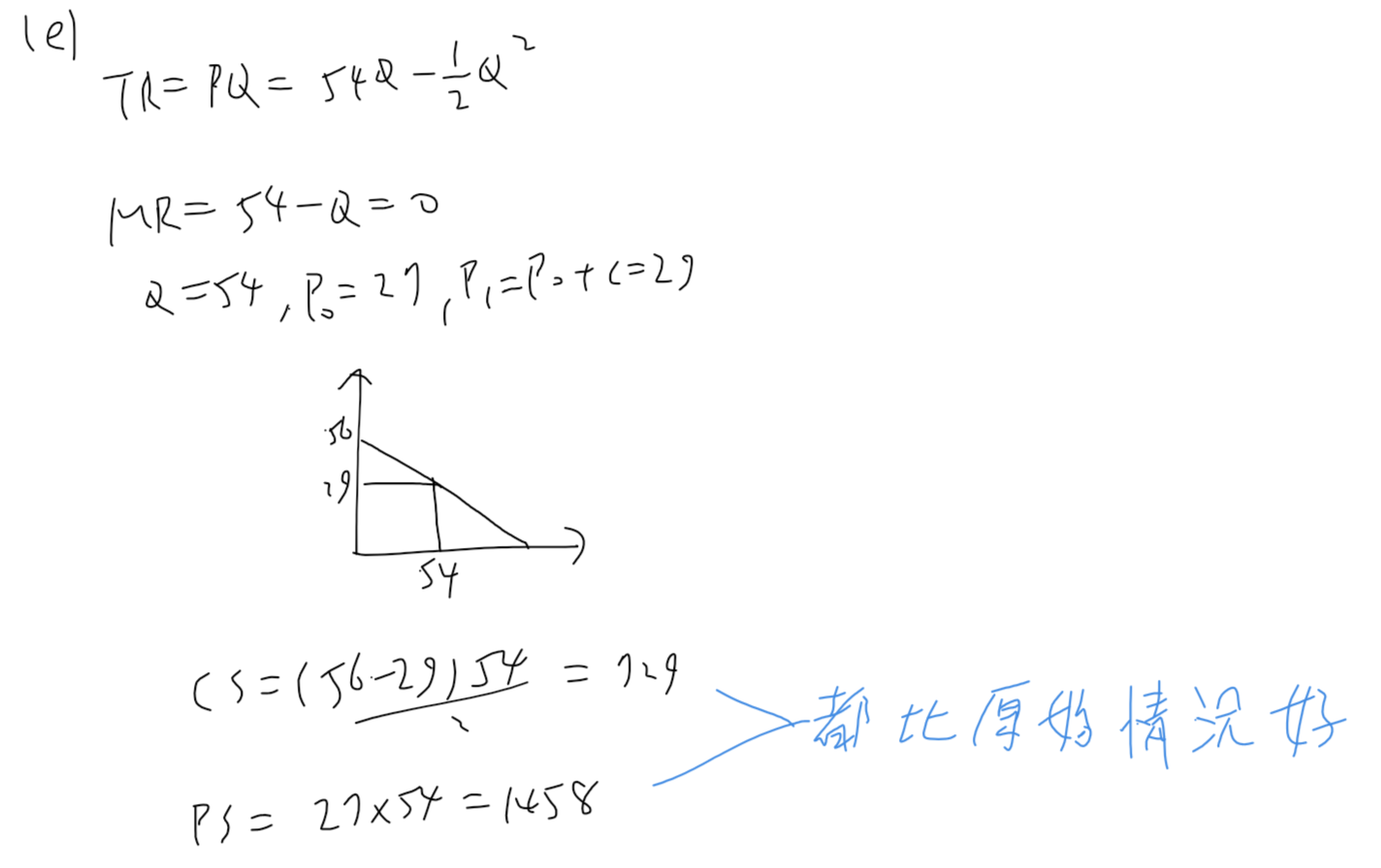

N4¶

橋有先後

橋有先後

i.e. 2nd bridge take 1st as given in (b)

thus idendical with N2(b)

P15¶

P18 (Solve cases of 4 and 5 vendors)¶

http://gametheory101.com/tag/hotellings-game/

five vendors:

http://gametheory101.com/tag/hotellings-game/

five vendors: