Principle of Macroeconomics¶

Resources¶

Ch23 GDP¶

Nominal GDP¶

See Macroeconomics#Ch2 產出與物價的衡量

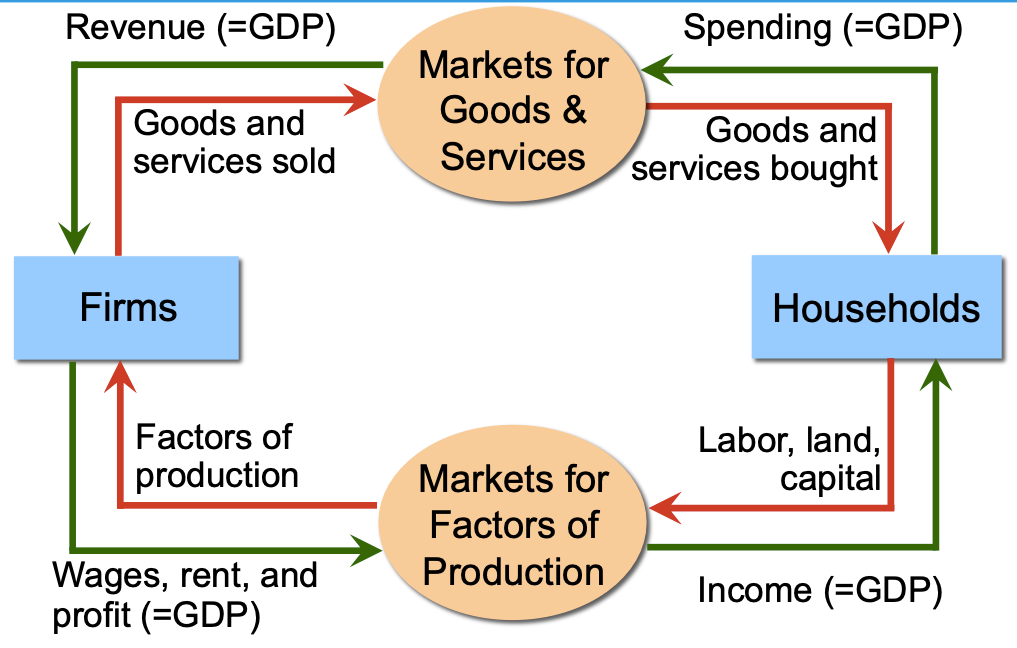

simplified diagram

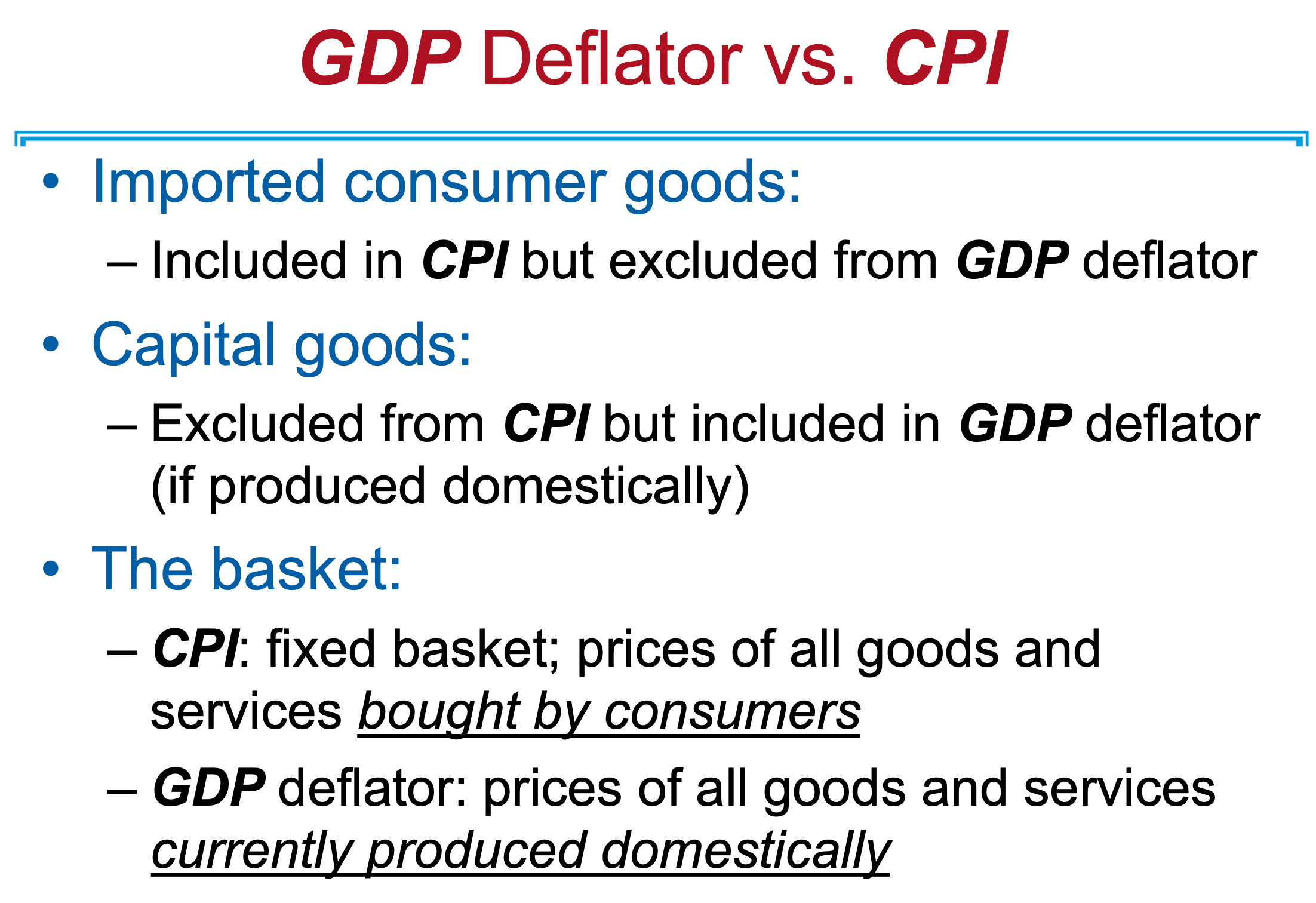

GDP Deflator¶

See Macroeconomics#GDP 平減指數 (GDP Deflator)

GDP deflator = \(\dfrac{\text{target year nominal GDP}}{\text{real GDP} = \text{base year prices}\times\text{target year quantities}}\)

- uses base year prices

- will underestimate inflation

problems¶

Ch24 Cost of Living¶

CPI¶

See Macroeconomics#消費者物價指數 (CPI, consumer price index)

CPI = \(\dfrac{\text{target year basket price}}{\text{base year basket price}}\)

- uses fixed quantities i.e. a basket of goods

- will overestimate inflation

- price of good A rises -> consumption of A reduces, but the quantity of it in the basket doesn't change -> overestimate CPI changes

- new goods introduced in the market -> more alternatives -> less consmption on original goods -> original goods' prices rise -> overstate cost of living

- quality of goods increases -> price increases -> overstate cost of living

Interest Rate¶

real interest rate = nominal interest rate - inflation rate

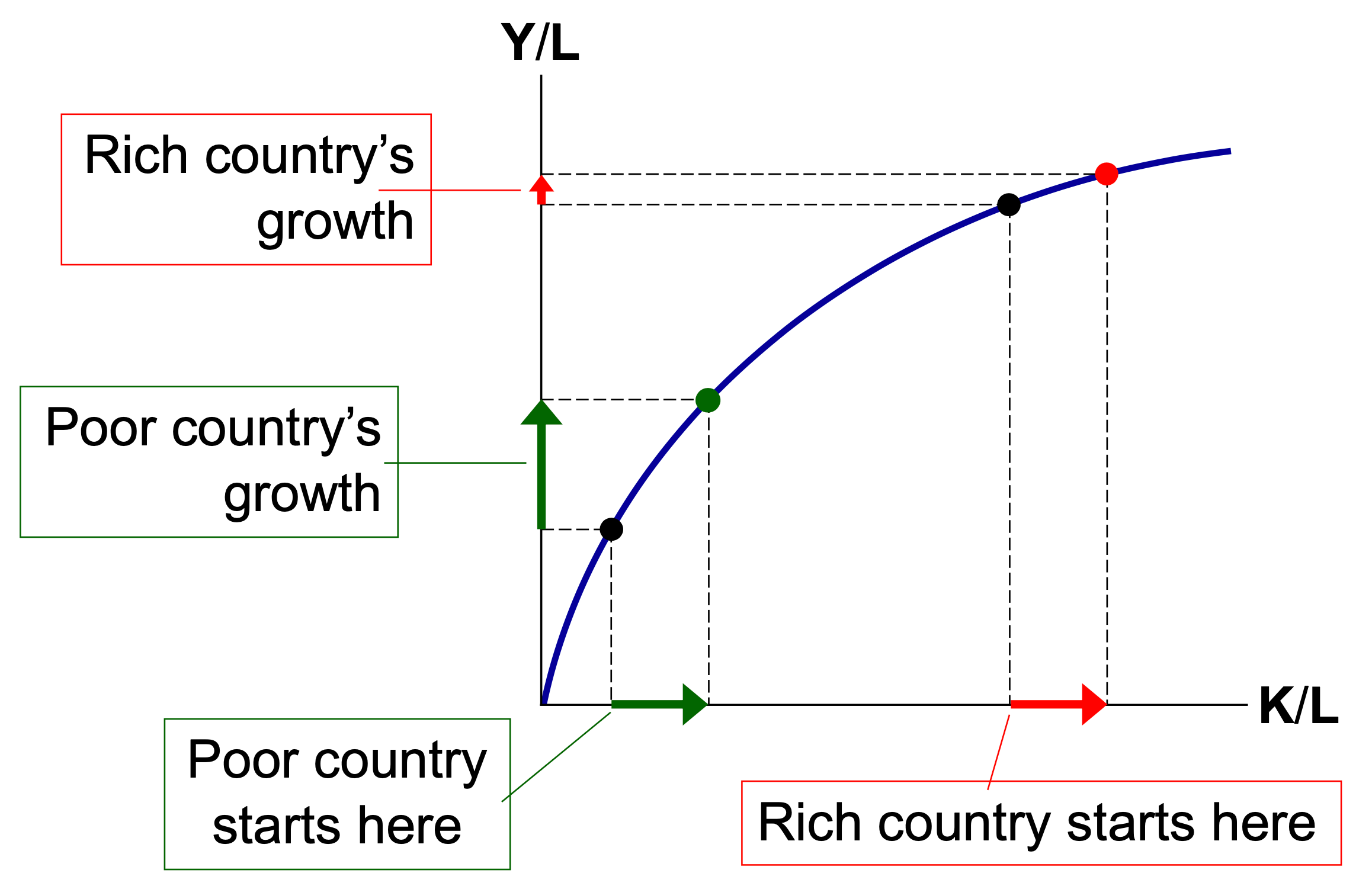

Ch25 Production and Growth¶

Production Function¶

- \(A\) = level of technology

- technology development of the whole society

- \(L\) = labor

- \(K\) = physical capital

- machines, equipments, structures, etc.

- \(H\) = human capital

- knowledge and skills of labor

- \(N\) = natural resources

- price natural resources are stable or falling

- meaning technology improvement mitigates the depletion of natural resources

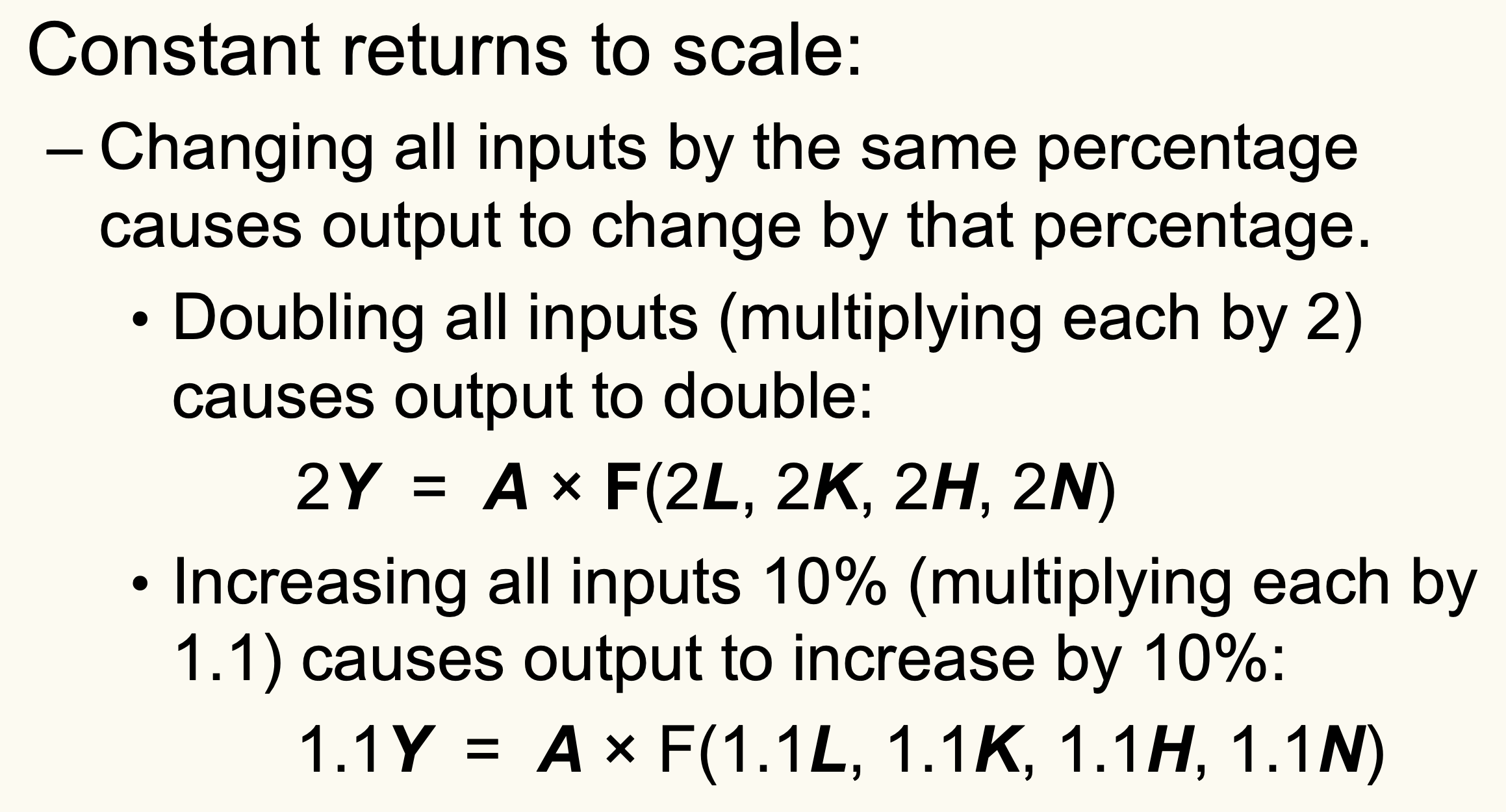

Constant return to scale¶

If all inputs change by x%, then the output will also change by x%

Things that help the economy¶

- education

- health and nutrition

- property rights

- honoring contracts

- political stability

- uncertainty for property rights

- free trade

- countries disallowing free trade generally fail to grow

- population growth

- market

- technology progress

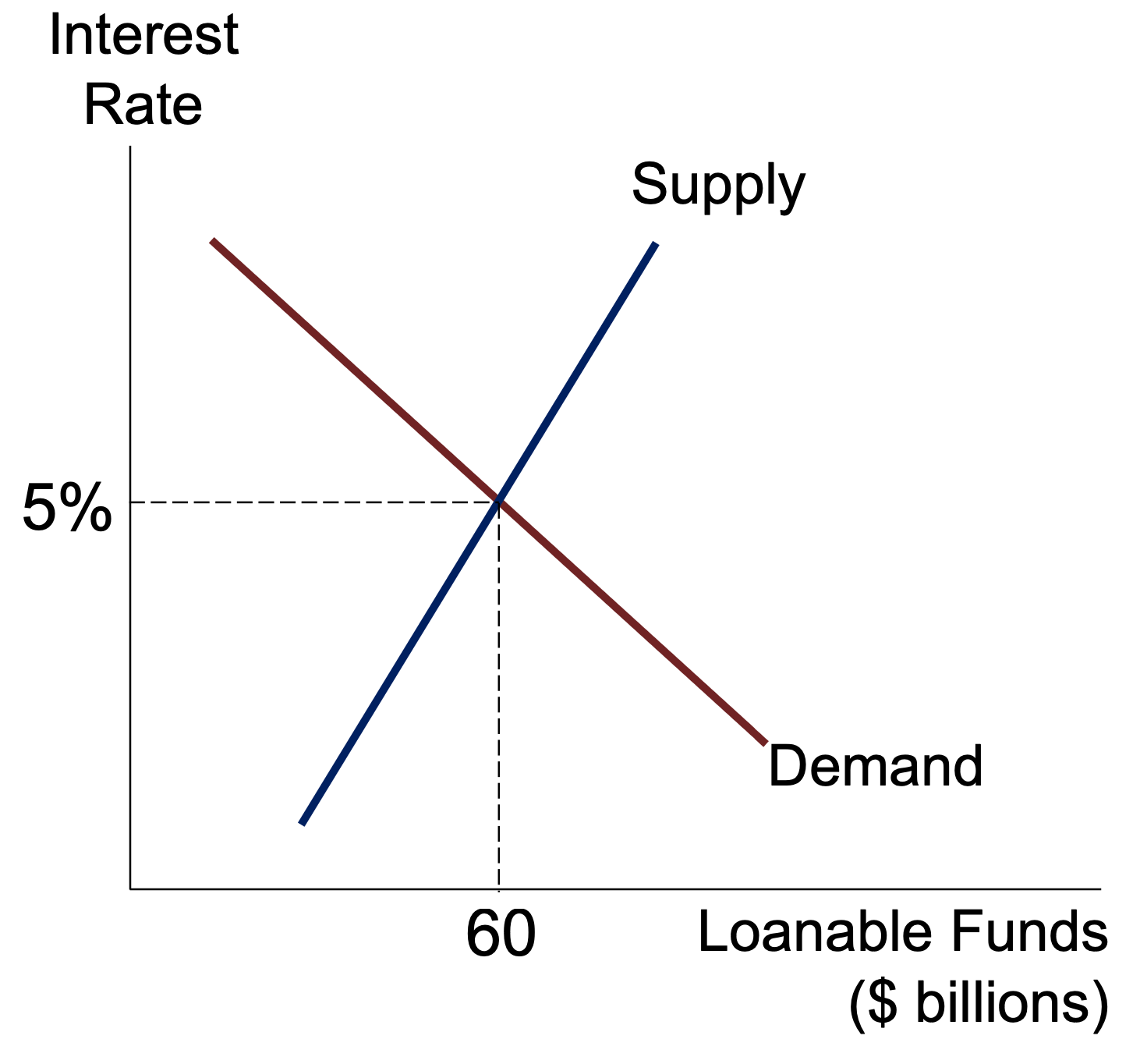

Ch26 Saving, Investment, and the Financial System¶

- \(Y\) = total expenditure = total income

- \(C\) = consumption

- \(I\) = investment

- purchase of new capital

- securities (e.g. stock & bonds) are not capital so not investment

- \(G\) = government purchases

- \(NX\) = net exports

Savings¶

- \(S\) = national saving = private saving + public saving

- \(Y-T-C\) = private saving

- income - tax - consumption

- \(T-G\) = public saving

- tax revenue - government spending

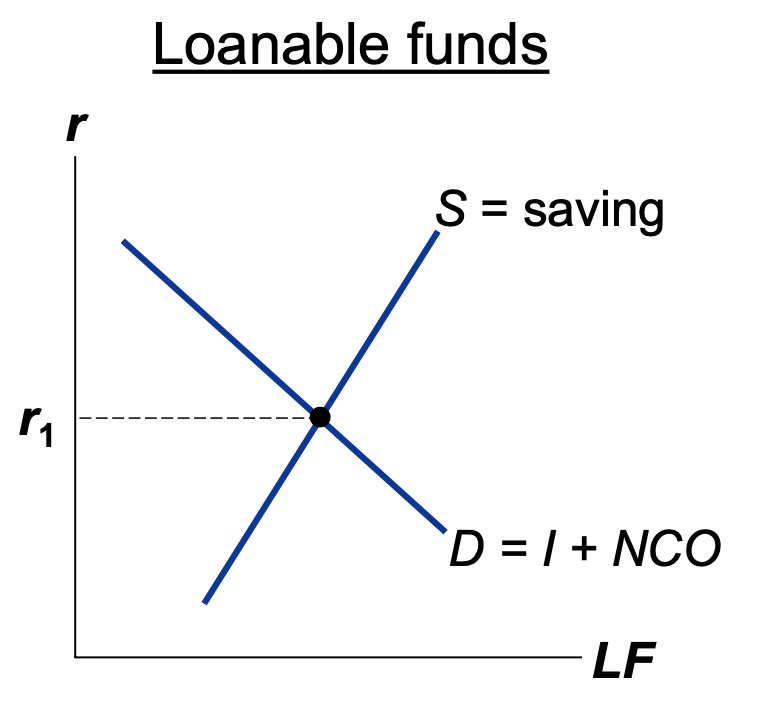

Loanable Funds Market¶

- supply = savings

- demand = investment

Ch27 Finance 101¶

Risk¶

concave utility funcion -> risk averse

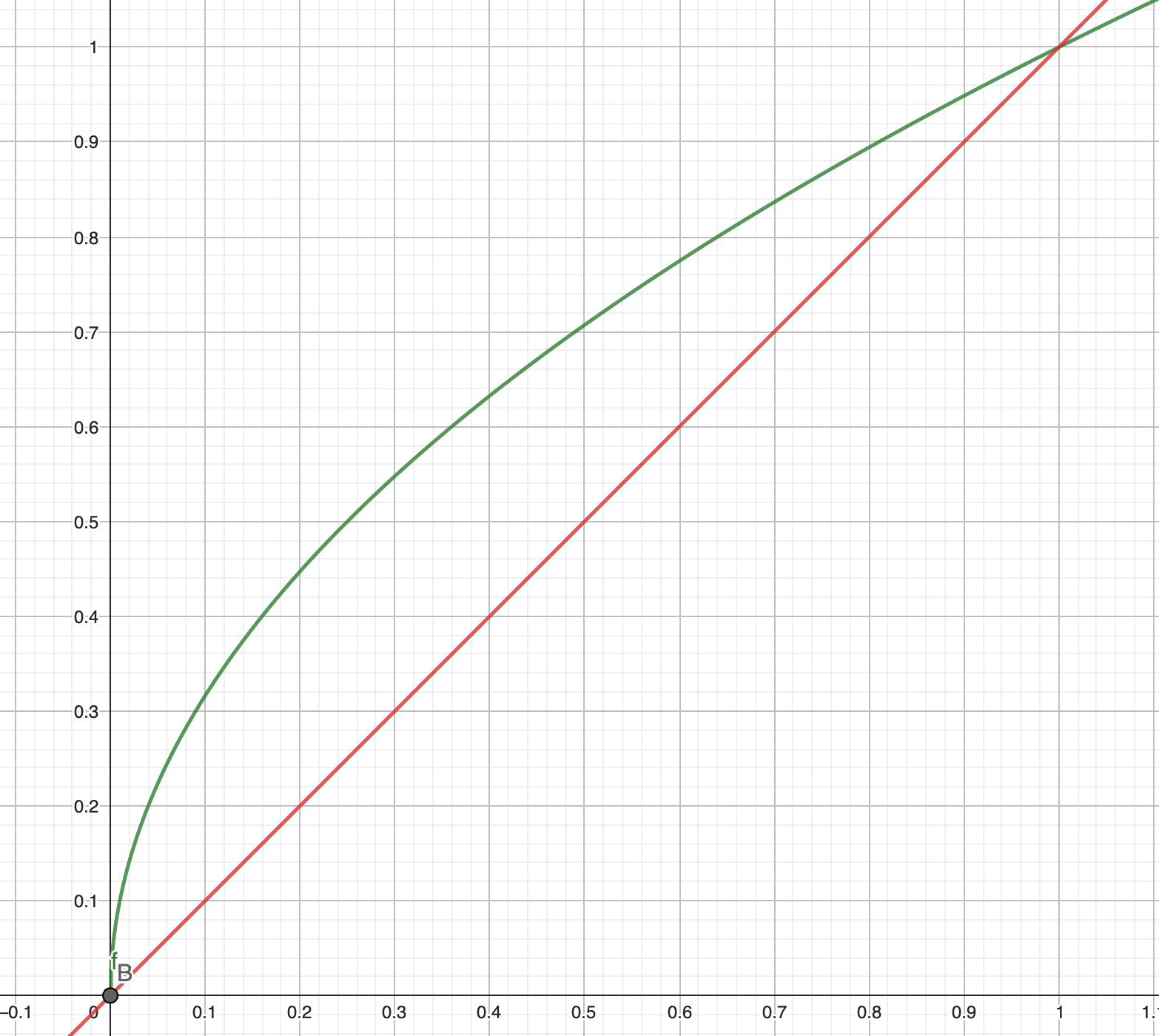

See this utility vs. wealth diagram, with the green line being the person's utility funciton.

Any risk combination of 0 & 1 will have the final utility fall on the red line, whereas a certain holding of the same expected wealth will fall on the green line, which is always above the red line, meaning this person is risk averse.

See also Ch18 Risk and Uncertainty

Efficient Markets Hypothesis¶

- asset price reflecs all publicly available information the value of the asset

- stock price is random

Ch29 The Monetary System¶

The Money Stock¶

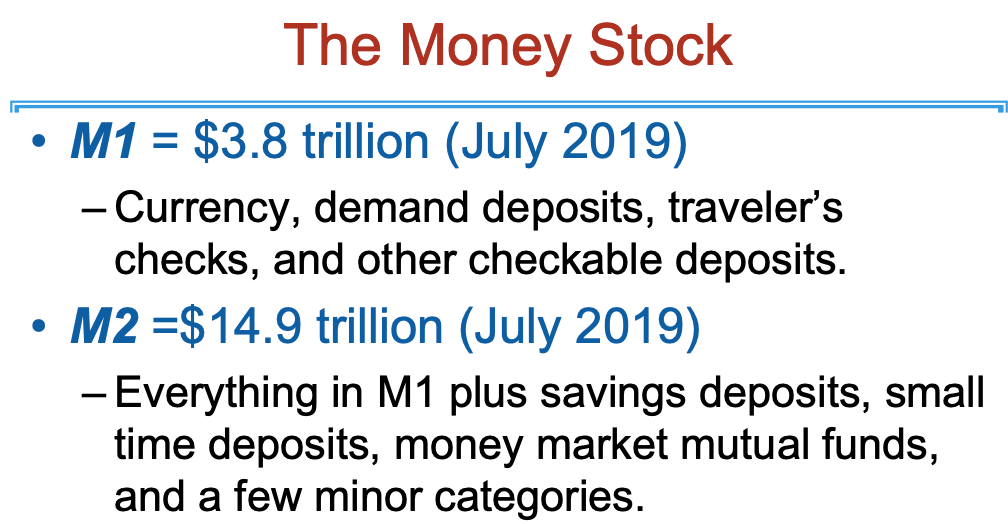

About M1 & M2, see Ch3 貨幣與支付系統#貨幣總計數

Bank Reserves¶

See Ch15 準備貨幣與貨幣的創造#15.4 存款貨幣的創造

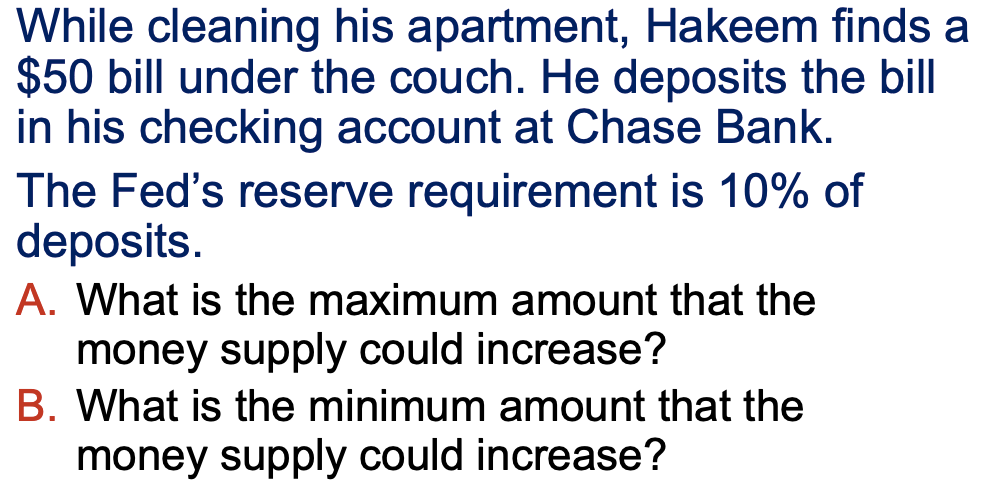

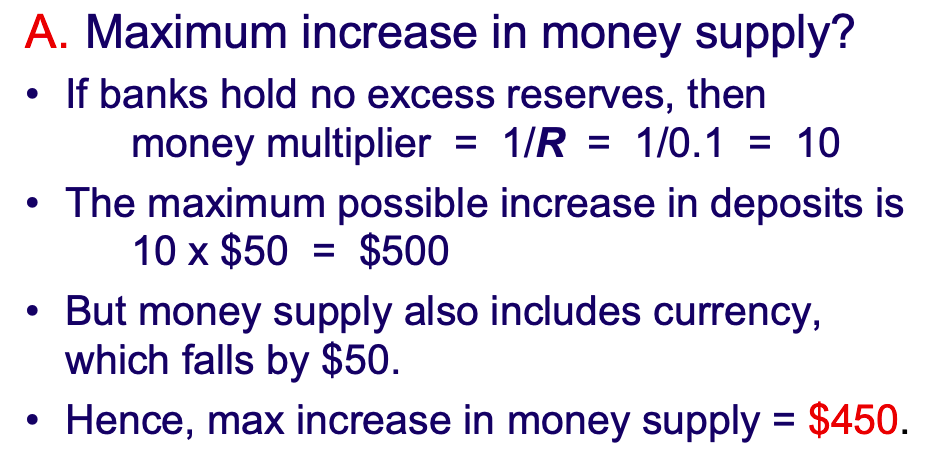

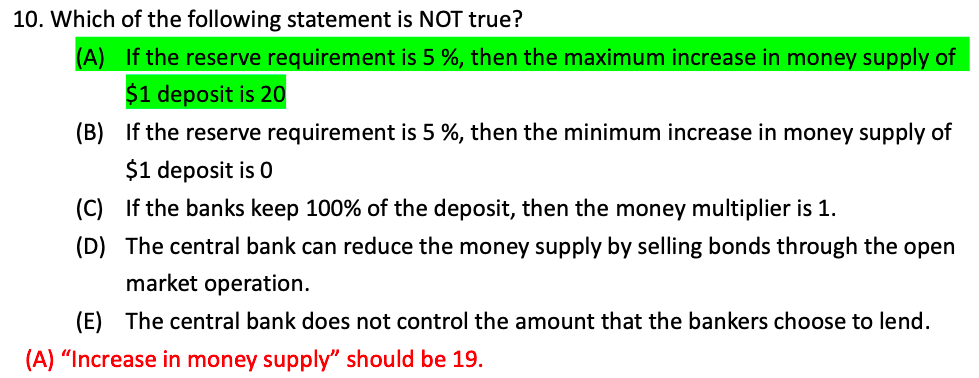

money supply = money / reserve rate

Suppose total currency = $1 and reserve rate = R, and there is an infinite number of banks

A deposits 1 to bank A -> B borrows 1-R from bank A and deposits it to bank B -> C borrows (1-R)(1-R) from bank B and deposits it to bank C -> ... -> 1/R of deposits in the system

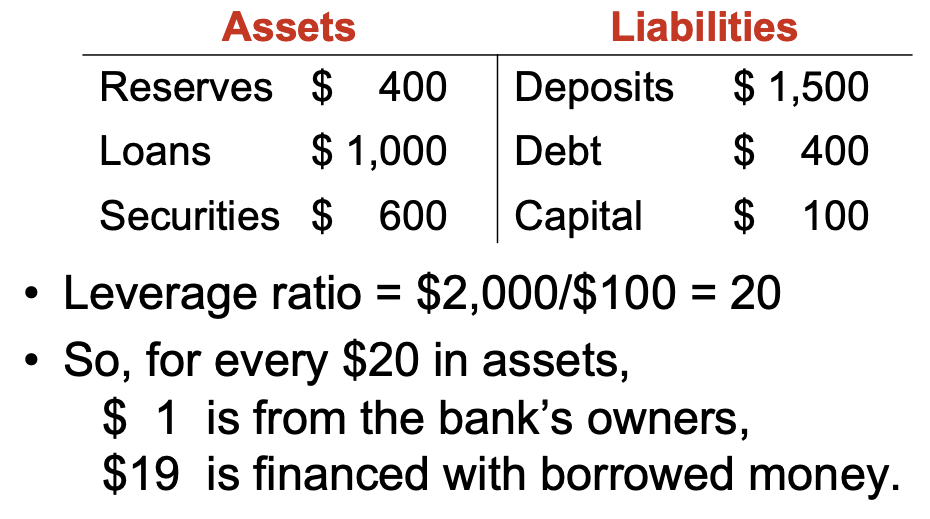

Balance Sheet¶

leverage = assets / capital = assets / assets - liabilities

Fed¶

See also Ch16 傳統與非傳統的貨幣政策工具

- Open Market Operations

- See Ch16 傳統與非傳統的貨幣政策工具#16.3 公開市場操作 open market operation

- buy & sell government bonds to change money supply

- discount window

- bank can borrow money from Fed's discount window

- interest rate of discount window = discount rate

- set reserve rate

- set interest rate on reserves

- higher -> more reserves -> lower money multiplier -> lower money supply

- set federal funds rate

- interest rate of overnight loans from one bank to another

Ch30 Money Growth and Inflation¶

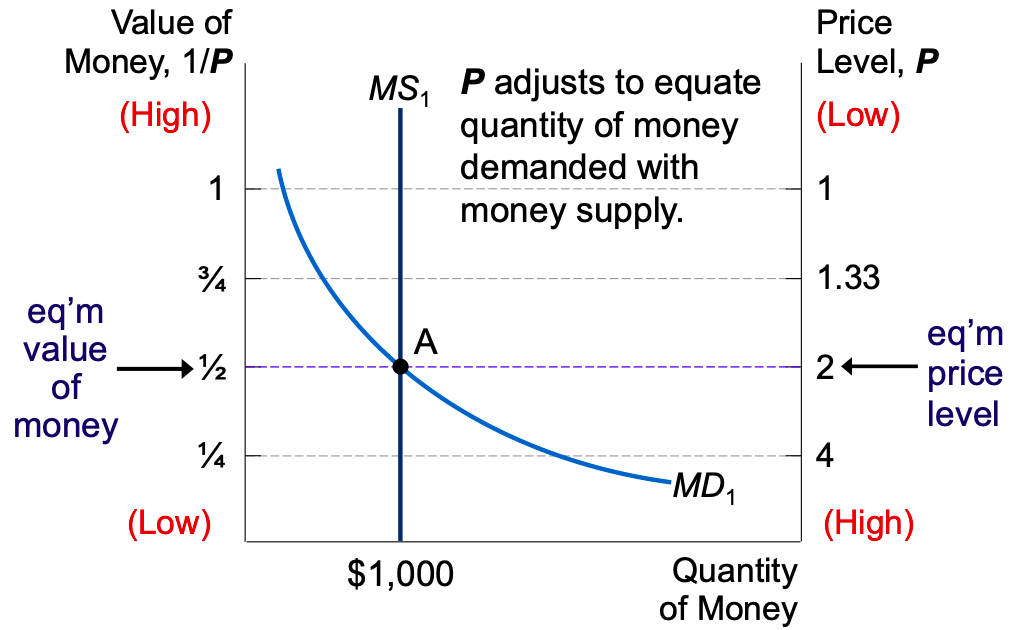

- price level \(P\) = the price of a basket of goods

- value of money = \(1/P\)

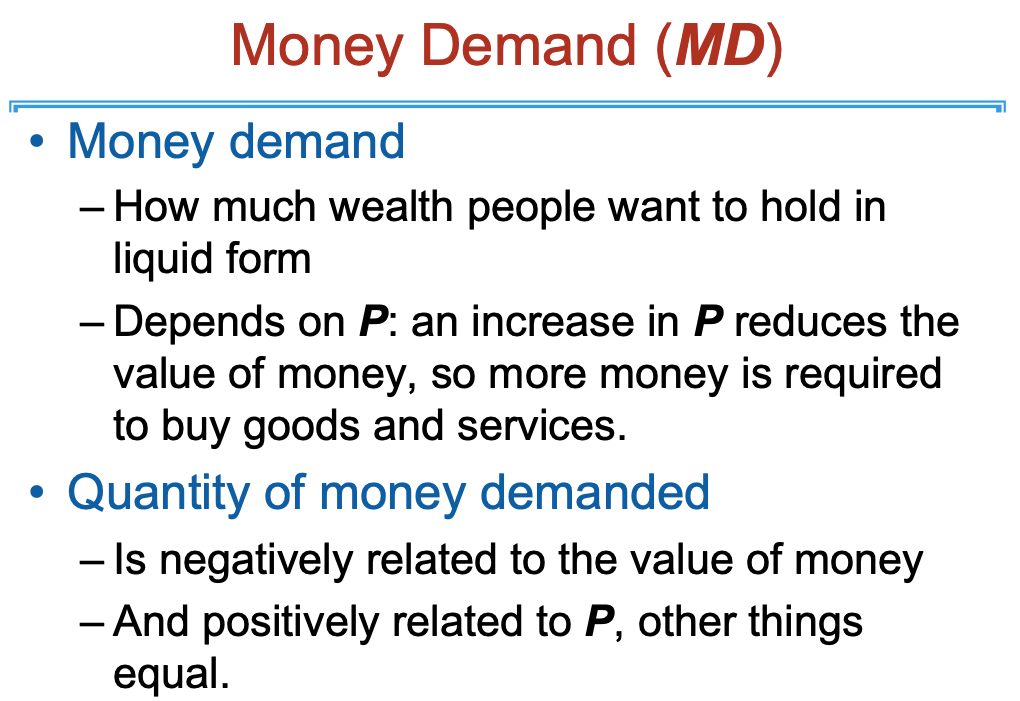

Money Demand¶

higher price level -> lower value of money -> higher money demand

Classical Economics Assumptions¶

- classical dichotomy: nominal doesn't affect real

- neutrality of money: money supply doesn't affect real

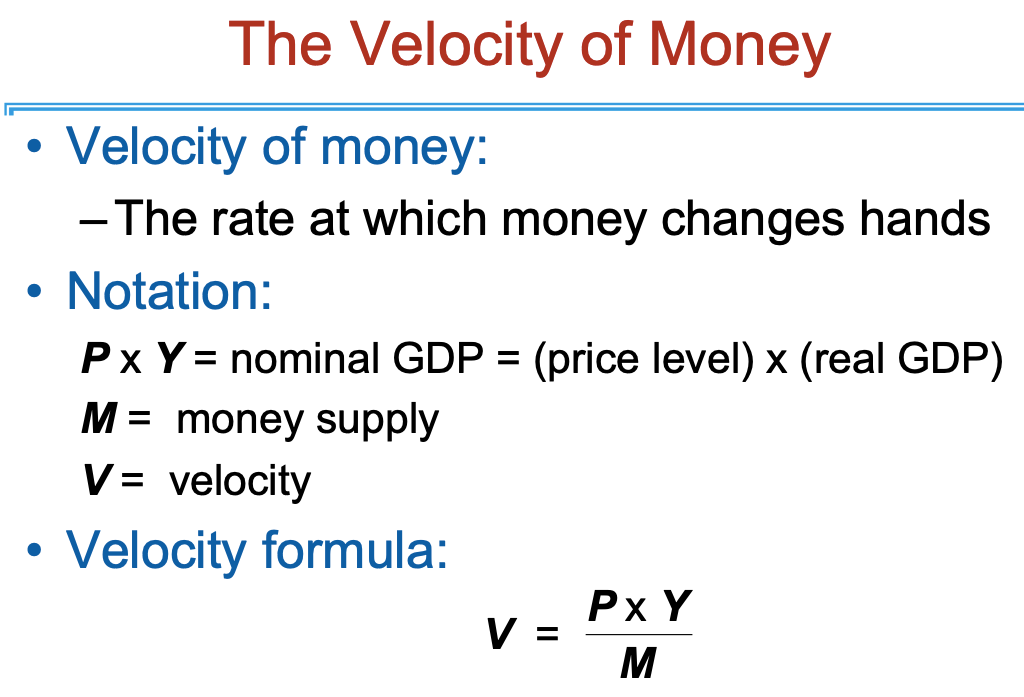

Velocity of Money¶

- price level \(P\) = nominal GDP / real GDP

- velocity of money \(V\) = nominal GDP / money supply

Quantity Theory of Money

velocity of money is stable, money supply doesn't affect real GDP, so money supply growth = inflation

Fisher¶

real interest rate = nominal interest rate - inflation rate

Unexpected Inflation¶

Unexpected high inflation helps borrowers and harms loaners.

Ch28 Unemployment¶

terminology¶

- employed = paid employees || self-employed || unpaid workers in a family business

- unemployed = not employed && have looked for a job within the last 4 weeks

- not in labor force = else

measurements¶

- population = employed + unemployed + not in labor force

- labor force = employed + unemployed

- unemployment rate (u-rate) = unemployed / labor force

- does not distinguish between full-time & part-time

- labor-force participation rate (LFPR) = labor force / adult population

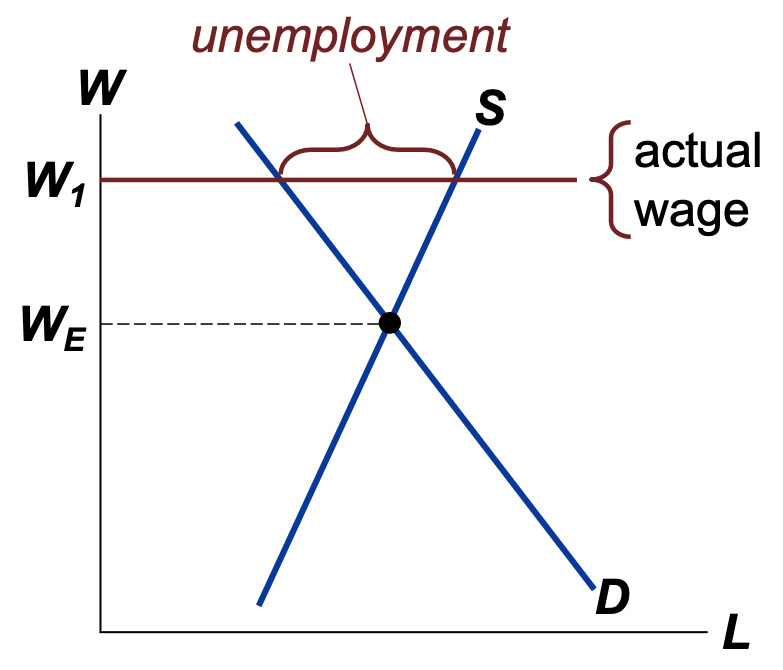

structural unemployment¶

Ch31 Open Economy Basics¶

saving¶

- NX = net export

- NCO = net capital outflow i.e. net foreign investment

- foreign assets purchased by citizens - domestic assets purchased by foreigners

saving = domestic investment + net capital outflow

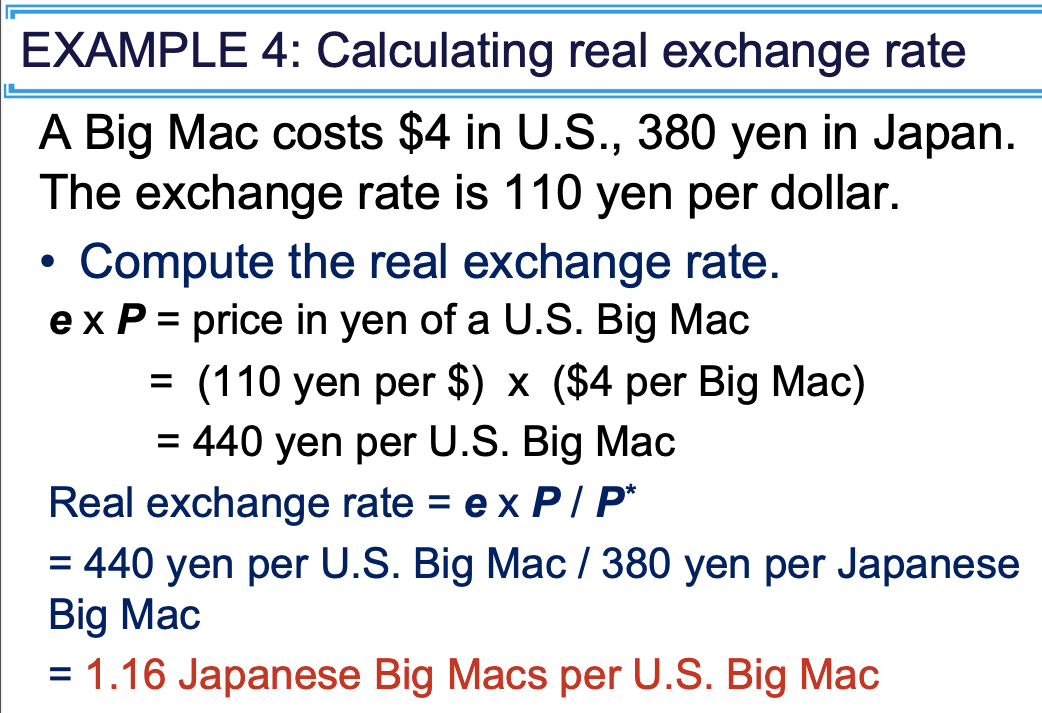

real exchange rate¶

real exchange rate = \(e\dfrac{P}{P^*}\)

- \(P\) = domestic price (in home currency)

- \(P^*\) = foreign price (in foreign currency)

- \(e\) = nonimal exchange rate (foreign/home)

purchasing-power parity PPP¶

See International Finance#absolute PPP

theory

- a good has the same price everywhere i.e. a currency has the same purchasing power everywhere, otherwise there will be opportunity for arbitrage (套利空間)

- the price level difference of two countries should be reflected in the exchange rate.

- price level changes -> nominal exchange rate changes

limitations

- many goods can't be easily traded i.e. arbitraged

- same good not the same in different countries i.e. preferences are not universal

Ch32 Open Economy Theories¶

NCO = net capital outflow

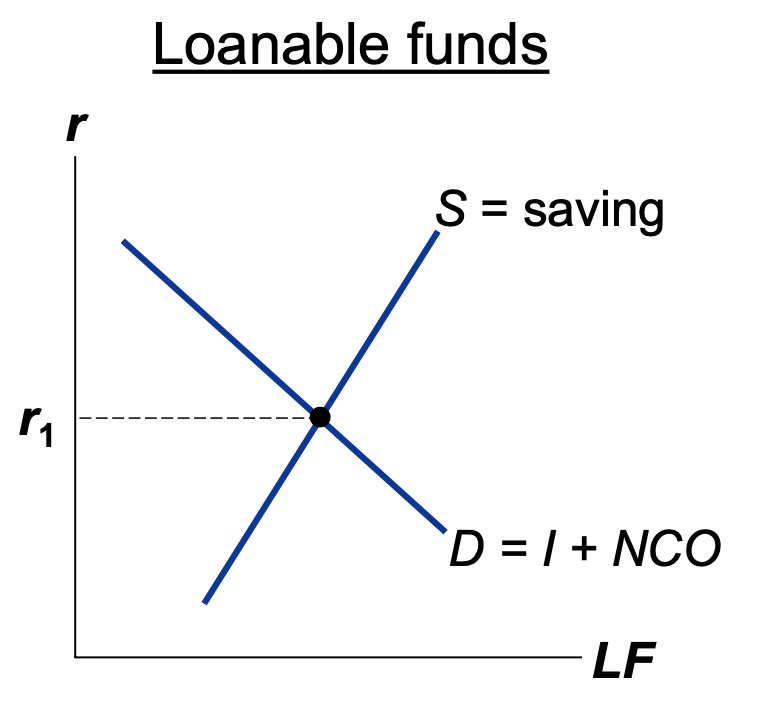

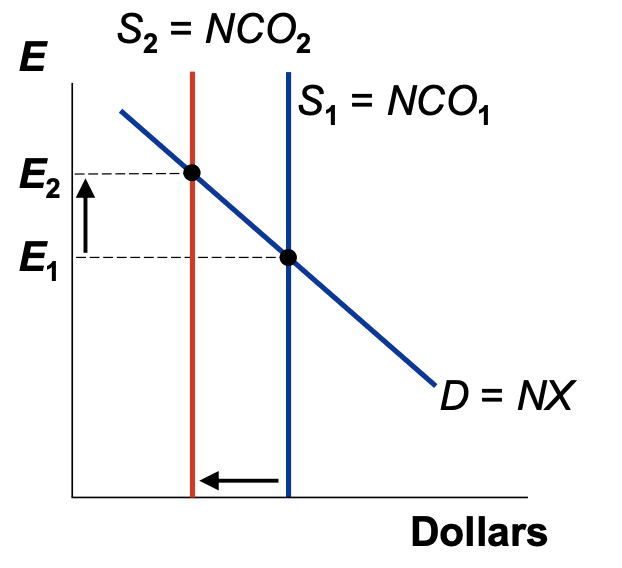

loanable funds market¶

- supply = national saving \(S\)

- demand = domestic investment \(I\) + net capital outflow \(NCO\)

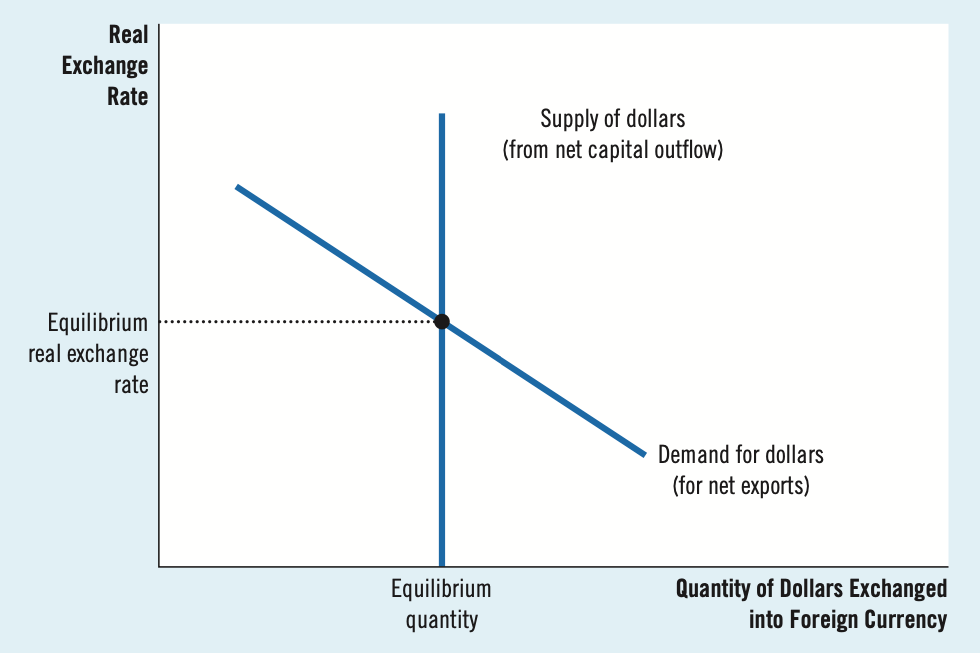

foreign-currency exchange market¶

- supply = \(NCO\) net capital outflow

- demand = \(NX\) net export

Ch33 Aggregate Demand and Supply¶

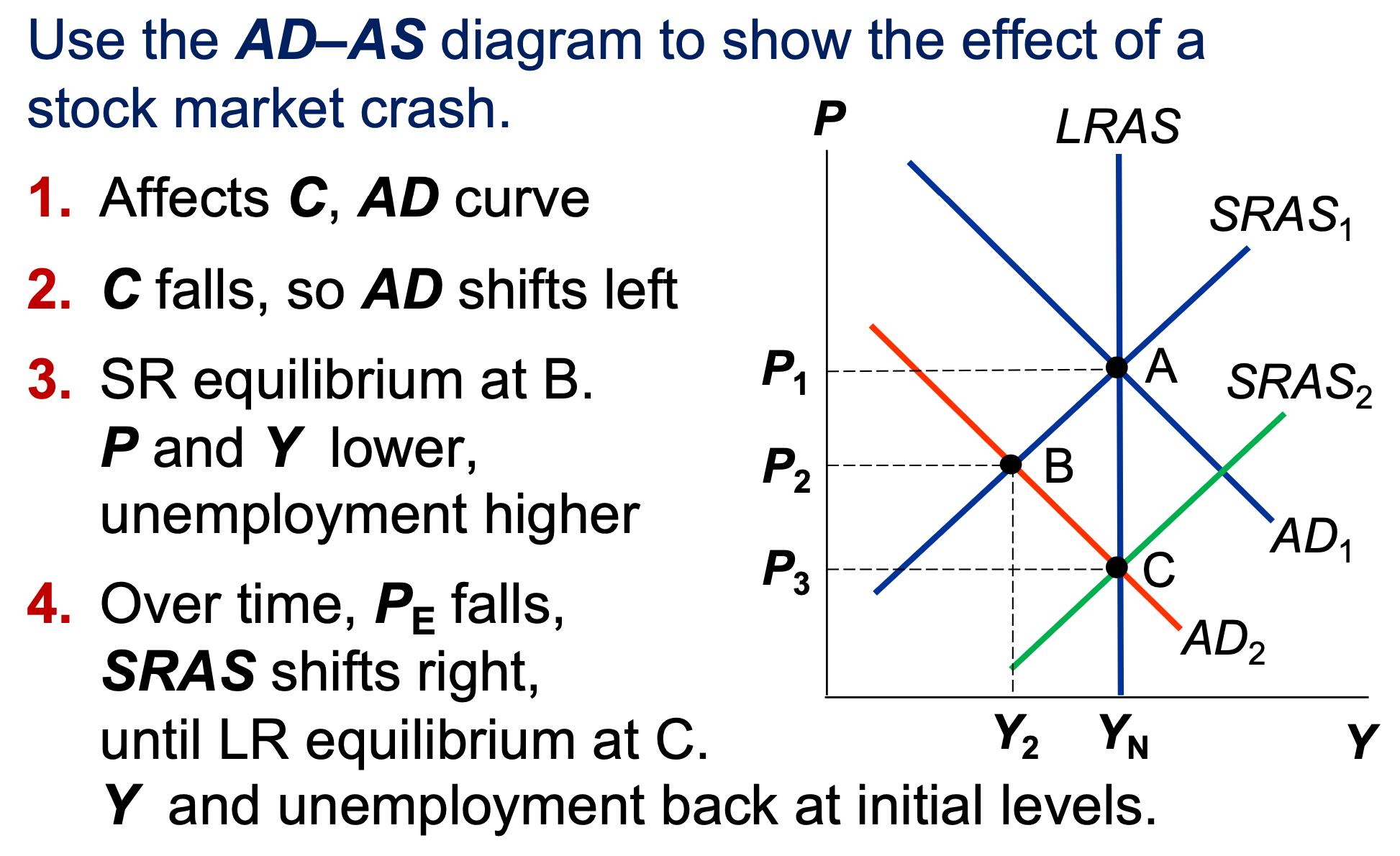

Economic Flunctations¶

- economic flunctuations are irregular and unpredictable

- most macroeconomic quantities flunctuate together

- when output falls, unemployment rises

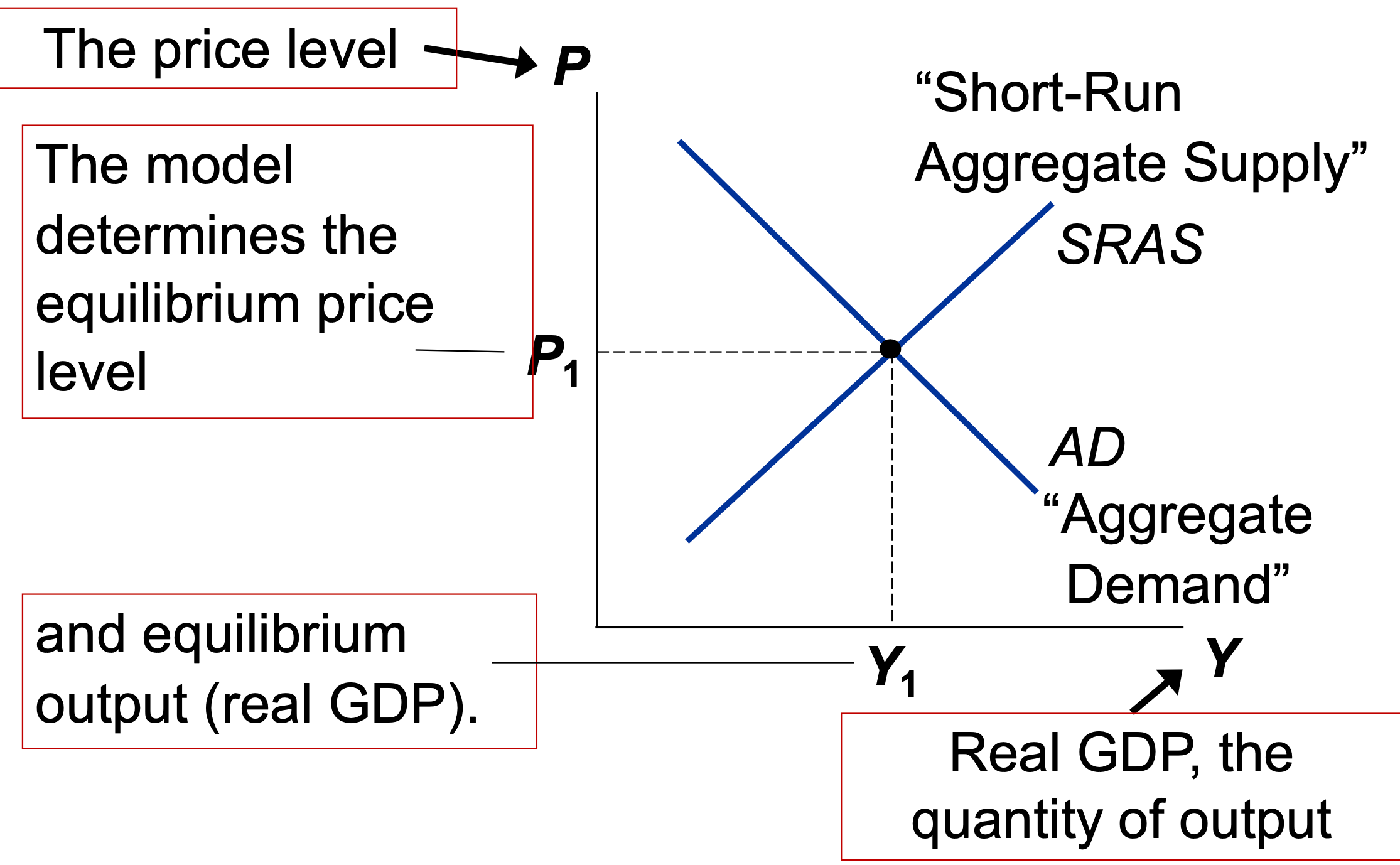

Aggregated Demand¶

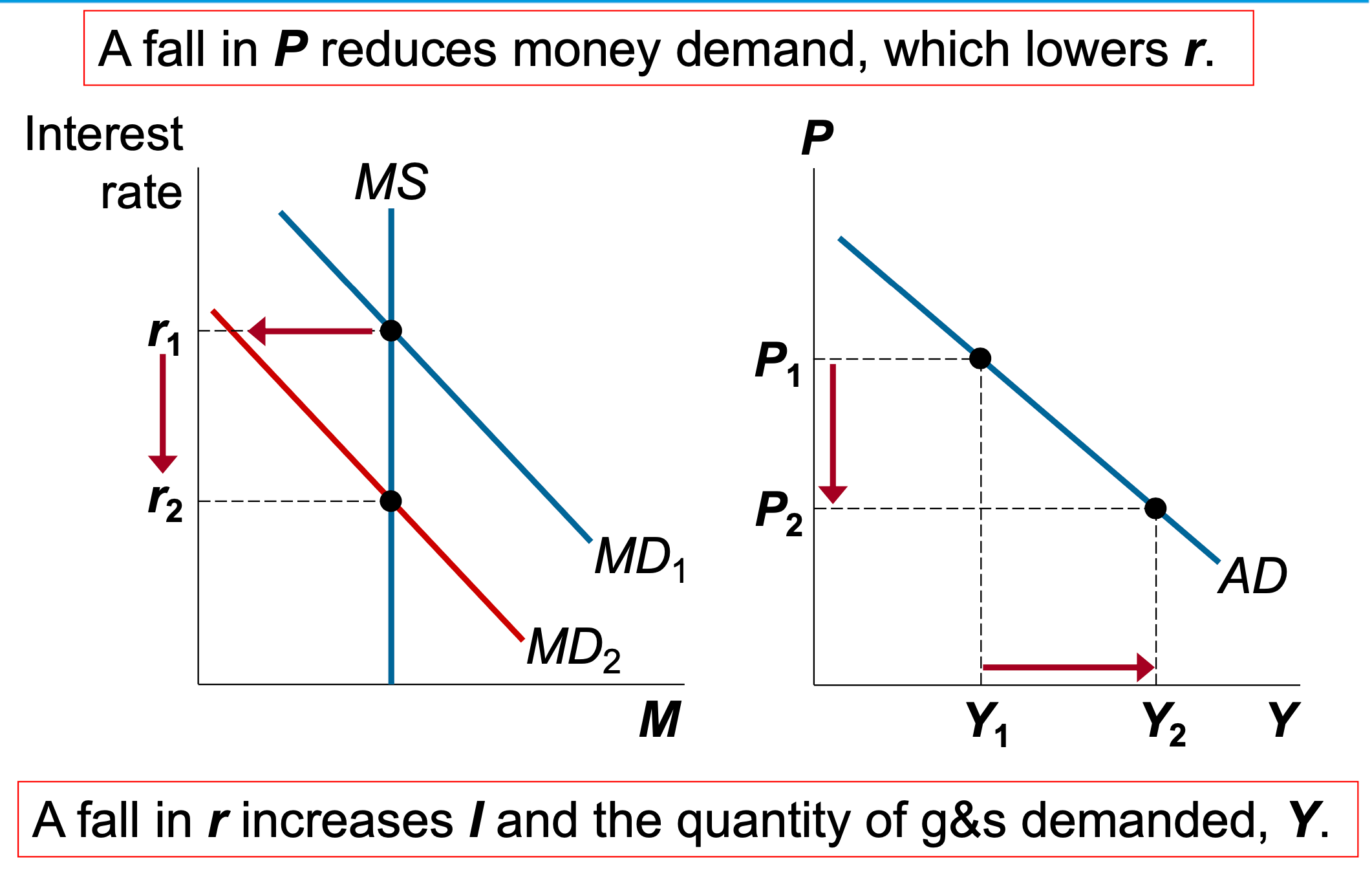

We know \(Y = C + I + G + NX\), assuming \(G\) no change, \(P\) has a negative effect on \(Y\)

- P down -> value of money up, wealth up -> \(C\) up, \(I\) up -> interest rate down -> \(NX\) up

- vice versa

Short-Run Aggregate Supply¶

In the short run, #Classical Economics Assumptions don't apply. Changes in nominal variables may affect real ones.

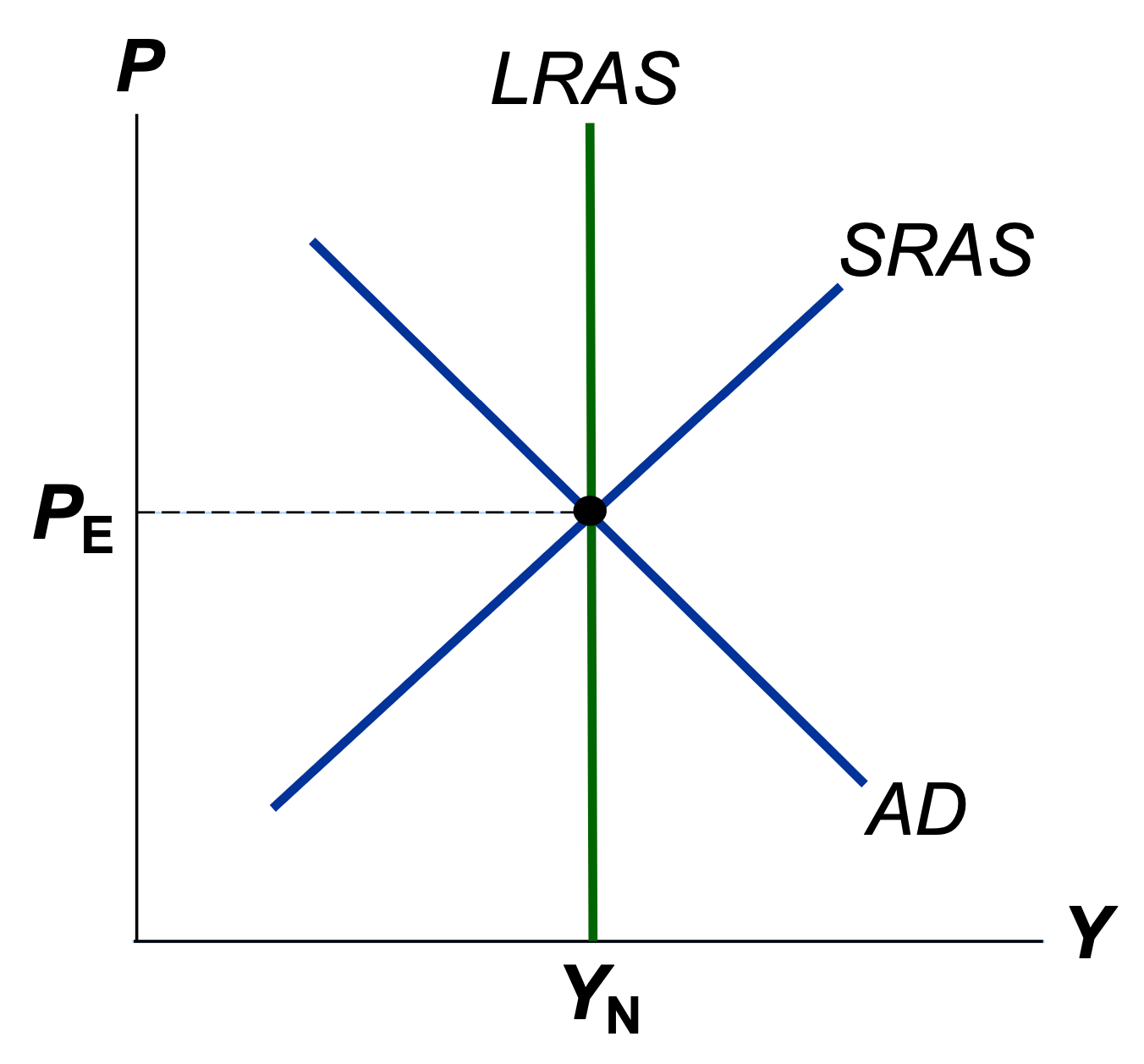

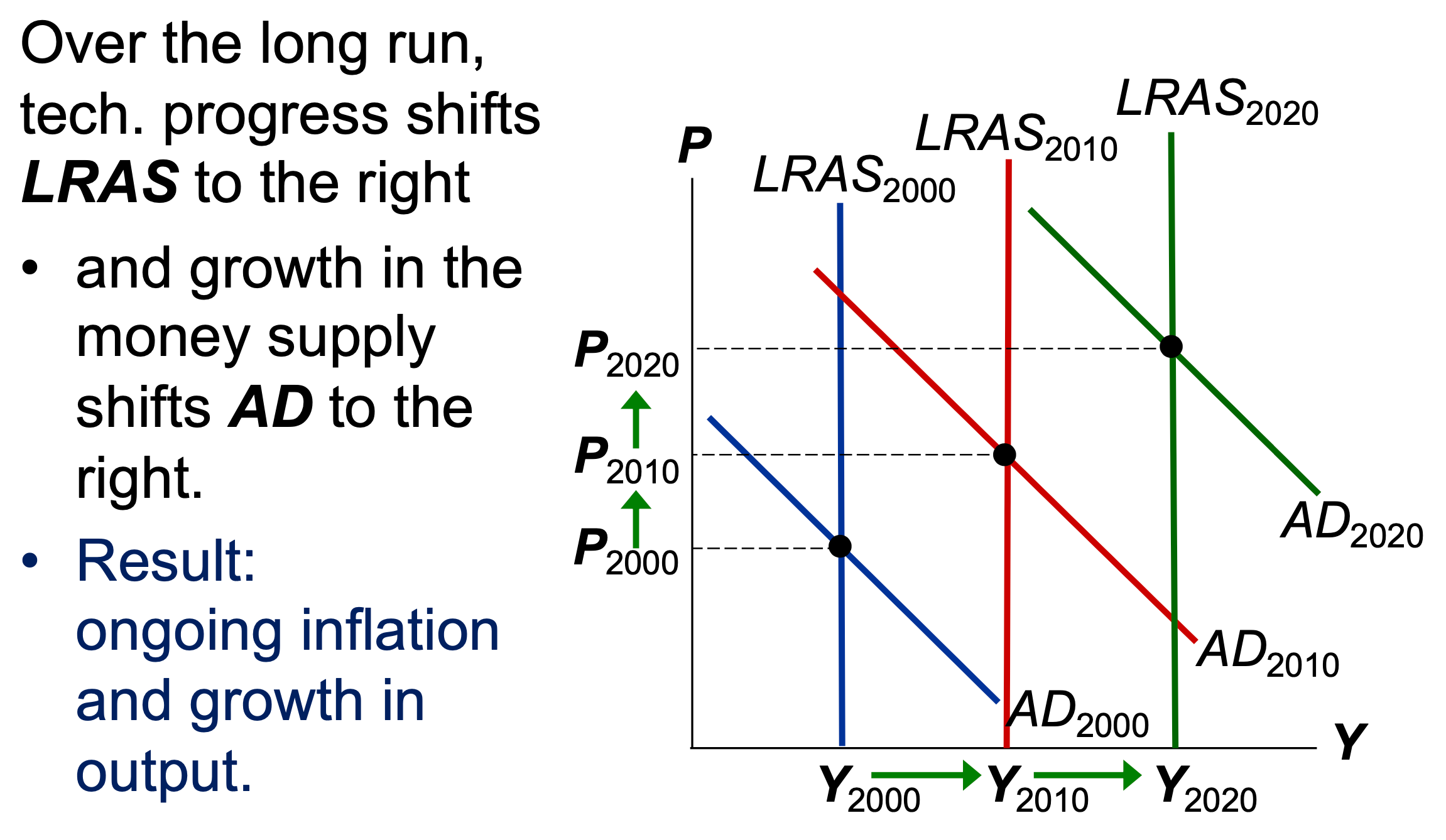

Long-Run Aggregate Supply¶

\(Y_N\) = natural rate of output = potential output = full-employment output

Long-run aggregate-supply curve is vertical since the natural rate of output \(Y_N\) is determined by labor, capital, natural resources, and the level of technology, which are not dependent on the price level. It's the classical dichotomy.

\(P_E\) = the expected price to prevail in the long run

inflation

Theories for Short-Run facing upward¶

short-run aggregate-supply curve

- \(Y_N\) = long run output

- \(P\) = actualy price level

- \(P_E\) = expected price level

Sticky-Wage Theory¶

- nominal wages is contant in the short run, based on \(P_E\)

- \(P\) up but wage stays the same -> more revenue -> increase \(Y\) & employment

Sticky-Price Theory¶

- many price is constant in the short run

- \(P\) up but product price stays the same -> product becomes relatively cheaper -> more demand -> increase \(Y\) and employment

Misperceptions Theory¶

- \(P\) up -> firm thinks its relative price rises -> increase \(Y\) and employment

Ch34 The Influence of Monetary and Fiscal Policy on Aggregate Demand¶

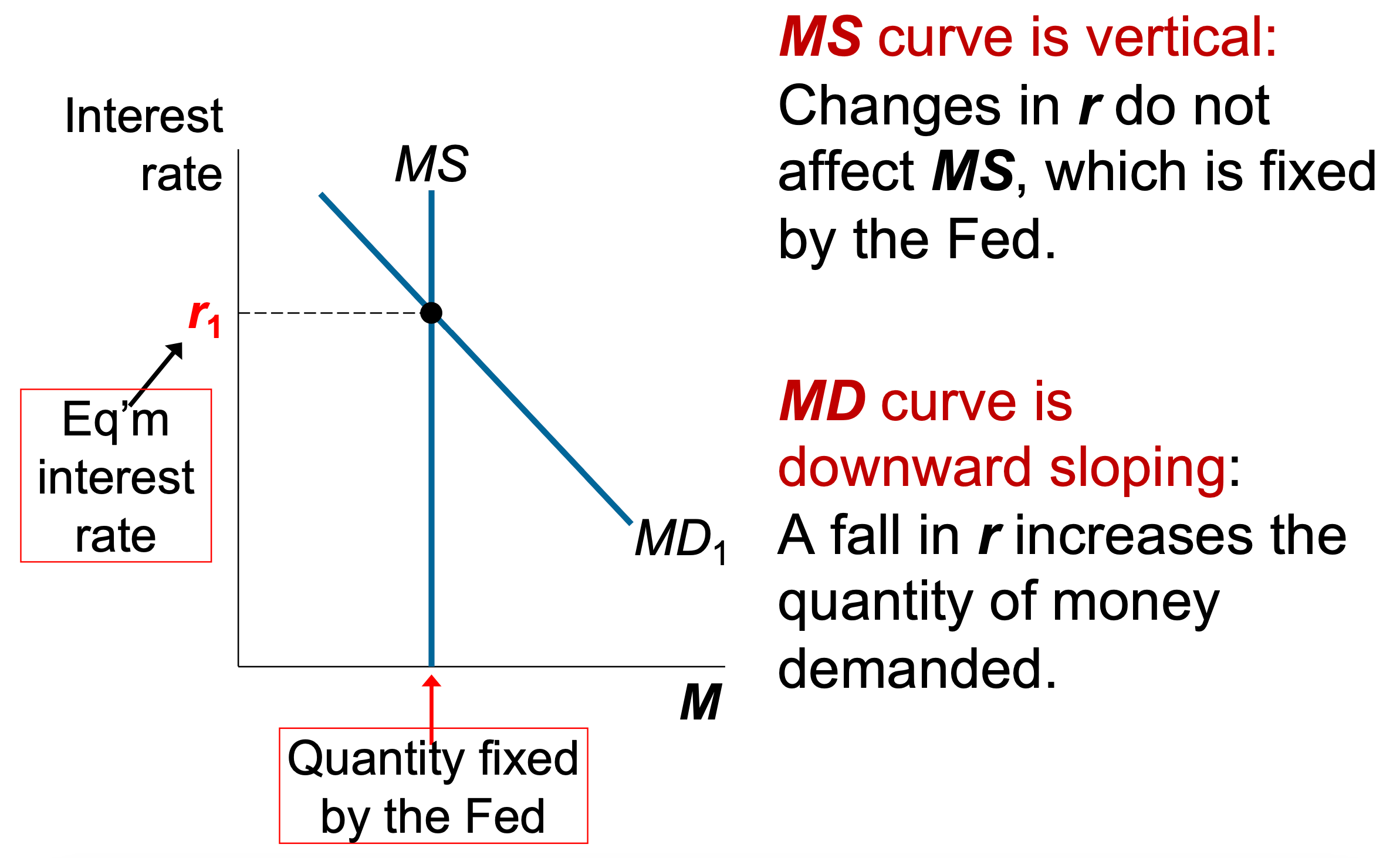

fed monetary policy¶

money supply MS is decided by the Fed

interest rate of bonds vs. quantity of money

Fed can influence AD by changing MS

zero lower bond¶

Ch16 傳統與非傳統的貨幣政策工具#16.6 名目利率零下限問題&負利率政策

nominal interest rate 0 -> can't be lowered any more, need to use other ways to affect aggregate demand, production, employment etc.

- raise inflation expectation

- quantitative easing

fiscal policy¶

\(G\) up or \(T\) down -> AD shifts right

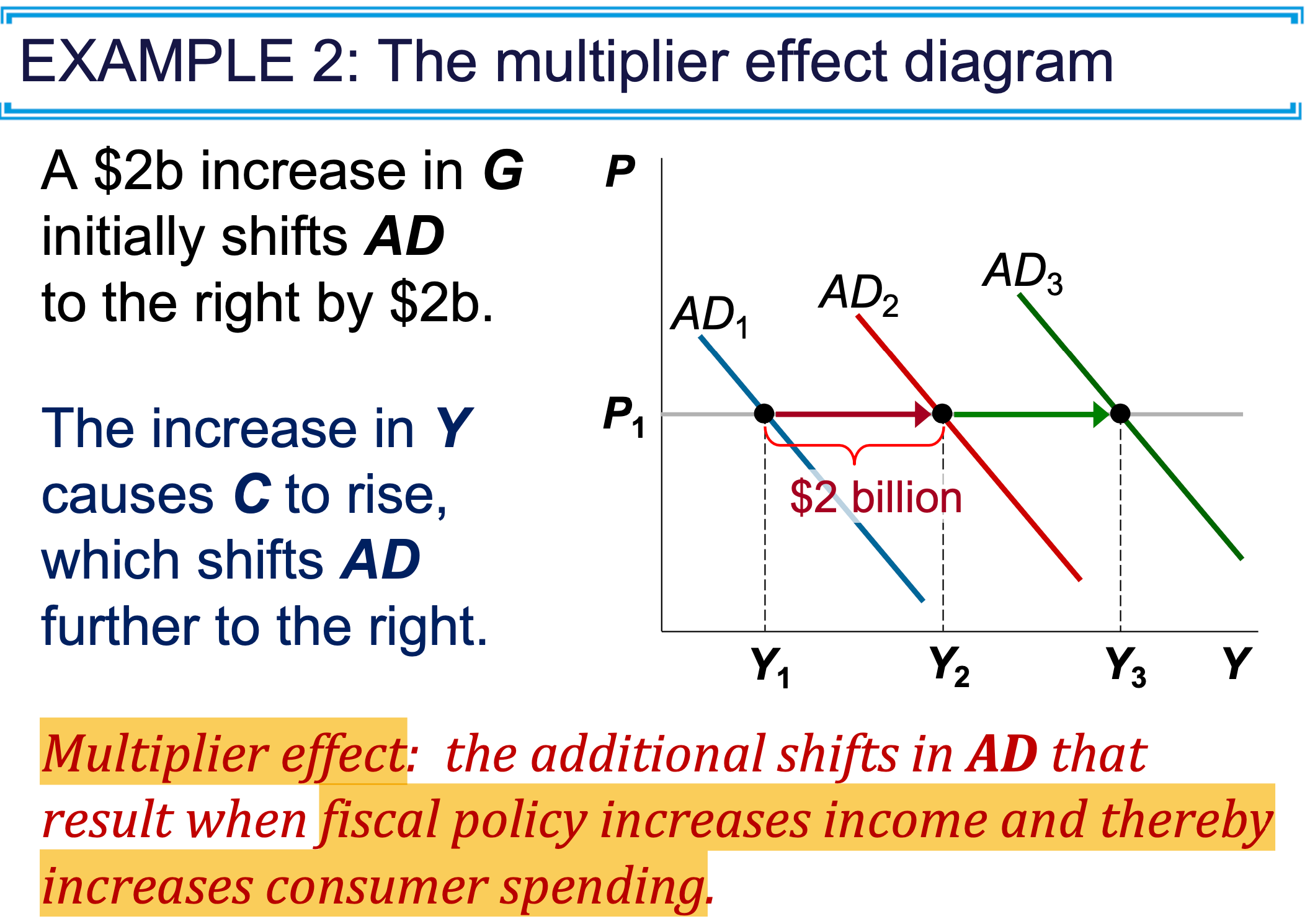

multiplier effect¶

government purchases from firm ->

- direct effect: AD shifts right

- income effect: firm revenue up -> worker income up -> consumption up -> AD shifts right

the magnitude of multiplier effect depends on marginal propensity to consume MPC = \(\dfrac{\Delta C}{\Delta Y}\)

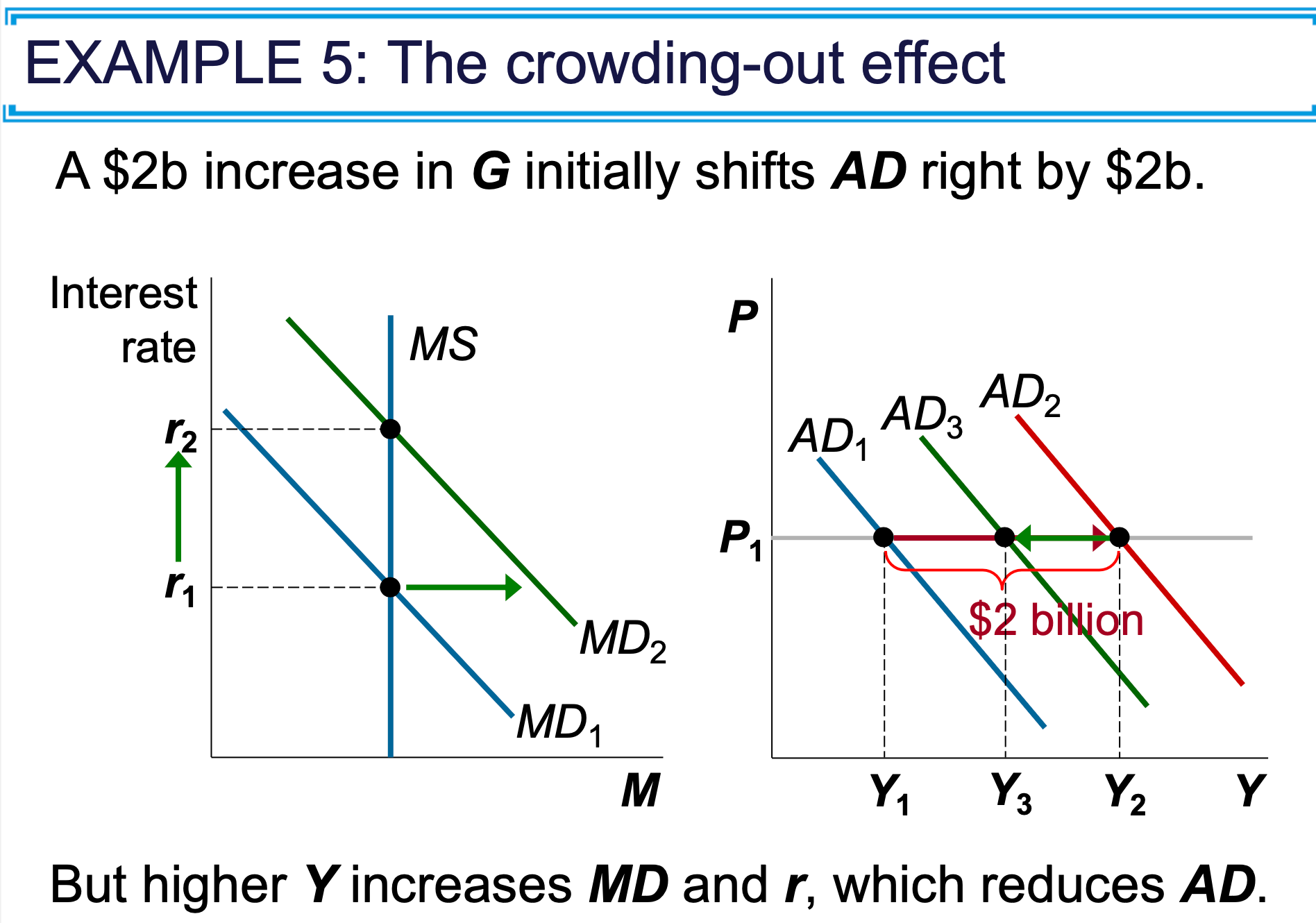

crowding-out effect¶

government spending

basically government spending reduces private consumption, see Macroeconomics#Ch7 靜態模型的均衡分析#政府消費支出增加

\(G\) up ->

- AD shifts right

- \(Y\) up -> MD shift right -> \(r\) up -> AD shifts left

- spend on infrastructure -> increase business productivity -> AS shifts right

tax

tax rate down -> more incentive to work -> labor up -> AS shifts right

policy effectiveness¶

- active policy

- investment takes time to affect interest rate

- takes 6 months for monetary policies to affect output & employment

- a change in government spending & tax requires congress approval, which takes time

- since active policies take time to take effect, they're not suitable to be used for short-term goals

- automatic policy

- tax reduces in recession naturally -> AD shifts right

- more people use social welfare system in recession, increasing government spending naturally -> AD shifts right

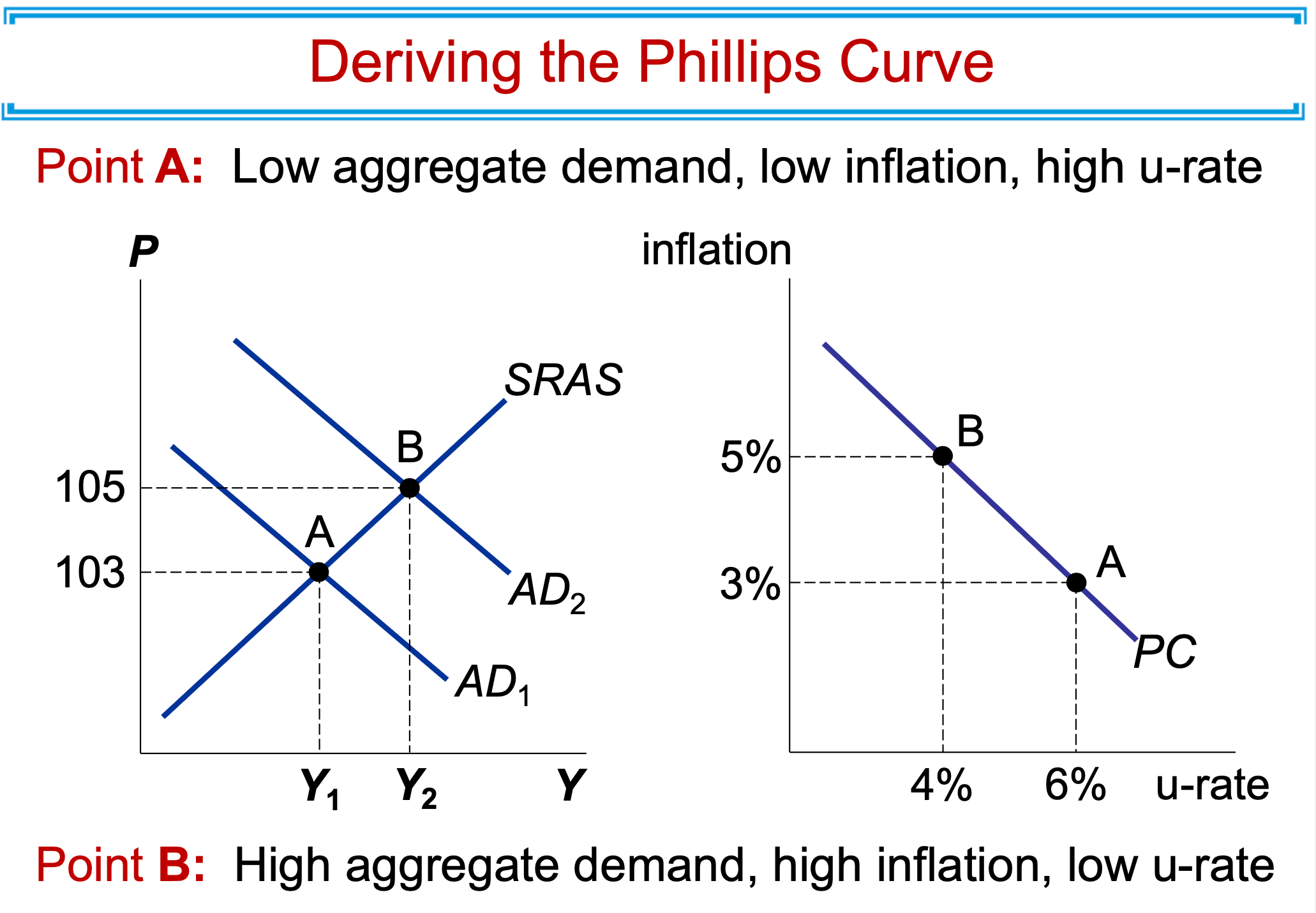

Ch35 Philips curve¶

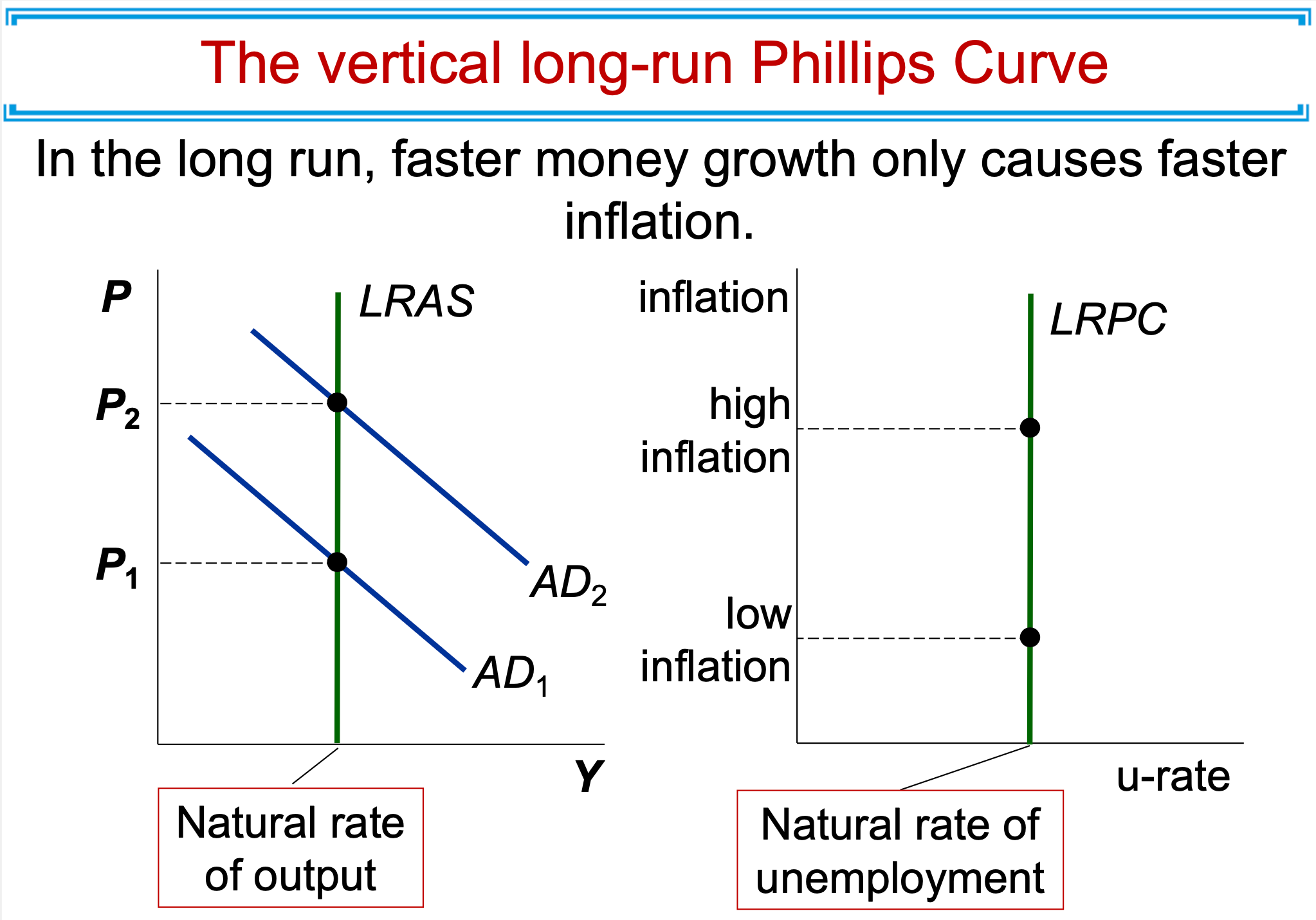

- in the long run, unemployment rate is independent of inflation rate

- in the short run, inflation rate can affect unemployment rate

Philips curve: inflation vs. unemployment rate

short-run¶

expected inflation & SRAS given in the short run

long-run¶

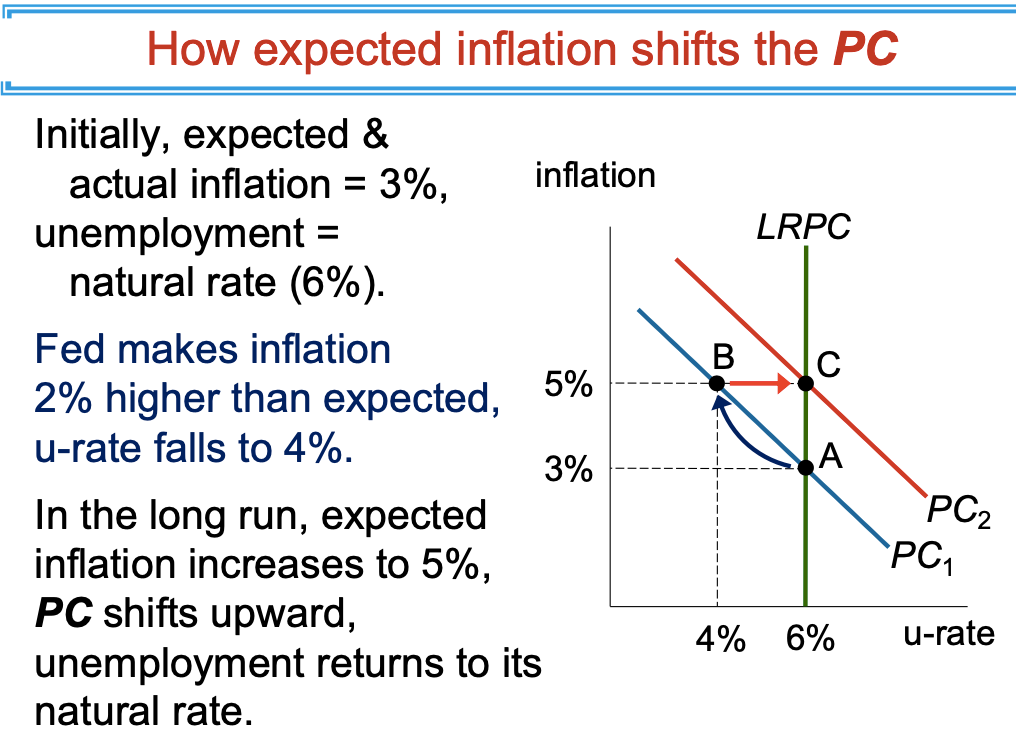

expected inflation is adjusted to the reality in the long run

monetary policy does not affect natural rate of X

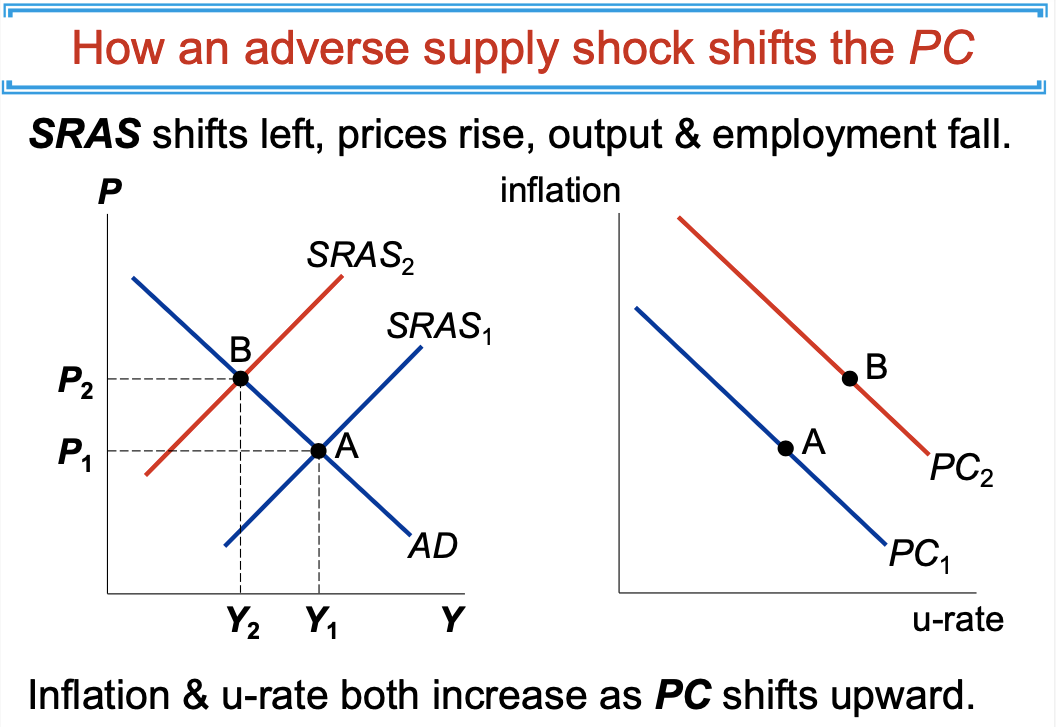

supply shock¶

supply shock affects AS & PC (philips curve)

disinflation¶

a reduction in inflation rate

sacrifice ratio = \(\dfrac{\Delta \text{output}}{\Delta \text{inflation}}\) = 5 typically

to reduce x% inflation rate, you need to reduce 5x% output

if everyone's rational, expected inflation falls when the Fed accounces to reduce inflation -> PC shifts downward -> smaller unemployment rate

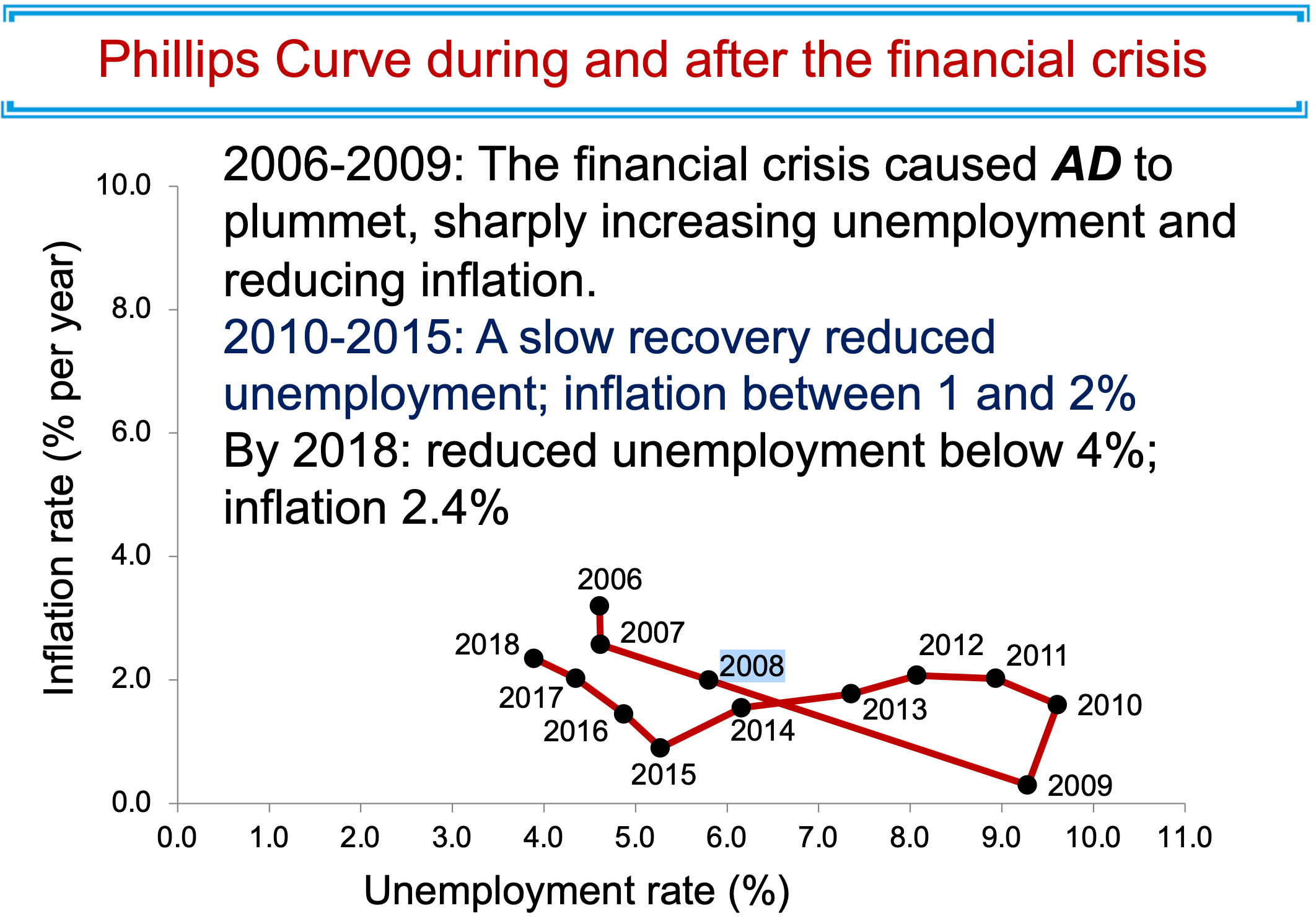

2008 financial crisis data¶

Ch36 Macroeconomic Policies¶

See Ch13 中央銀行的功能與政策目標#13.4 央行制度

active stabilization¶

- pros

- help stablize the economy

- cons

- policies have long delay, making them ineffective

government spending¶

- aggregate demand directly boosted

- give money to the states to maintain the employment of their workers

tax cut¶

- increase consumer income -> increase consumption

- higher wage -> increase the incentive to work -> increase aggregate supply

- may increase aggregate demand with investment tax credit etc.

policy discretion¶

- pros

- flexible

- hard to specify rules

- cons

- abuse

- political business cycle

- time-inconsistency

zero inflation¶

- pros

- temporary costs but permanent benefits

- cost i.e. unemployment rate can be reduced if Fed's credible -> expected inflation rate reflects policy

- temporary costs but permanent benefits

- cons

- small benefits big cost i.e. unemployment rate

- sacrifice ratio = 5

- investment reduced

- small benefits big cost i.e. unemployment rate

balanced budget i.e. no deficits¶

- why deficits bad

- debt places burden on future generations

- deficits crowd out investment

- sell government bonds for funding -> soak up money otherwise used for investment on business

- why deficits not so bad

- burden placed on a person from government debt is tiny

- harm of cutting deficits

- social welfare reduced

- tax increased

- what important is debt/income ratio not the absolute debt amount

tax reform to encourage saving¶

- why Murica needs tax reform to encourage saving

- current Murican tax system descourages saving

- high marginal tax rate (of income) -> less incentive to save

- some saving is taxed twice

- high tax rate on bequests

- can replace income tax with consumption tax to incentivize saving

- should exempt on necessities, otherwise it's just eating the poor

- current Murican tax system descourages saving

- why Murica doesn't need tax reform to encourage saving

- tax reform encouraging saving just benefits the rich

- elasticity of saving on rate of return is low, so tax reform won't do much

- may increase government budge deficits -> lower public saving, cancelling out the increase of private saving

- can increase national saving simply by reducing budge deficit