Ch17 Allocating Goods Over Time

Interest_Model Interest_equilibrium Interest_RA Interest_Recardian_Eq

interest rate¶

A 是貸款人

目標:今天放款,日後收取更多錢 i.e. r > 0

B是借款人

目標:想買東西,目前錢不夠,先貸款,提早享受,之後願意付更多錢

interest rate = 現在幣值 : 未來幣值

e.g.

某沙發可用四年,對你的價值為 $100/year (in each year's stantard)

interst rate = 10%/year

if 現在賣 $100*(1+1/r+1/r**2+1/r**3) = $349 以下

則該買

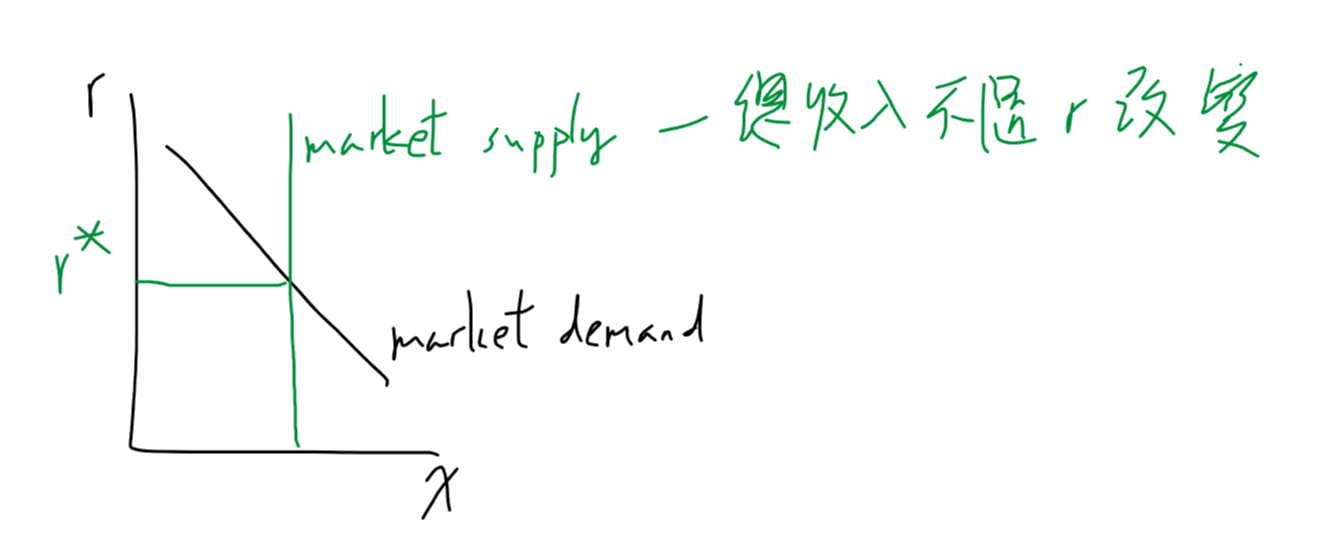

interest equilibrium¶

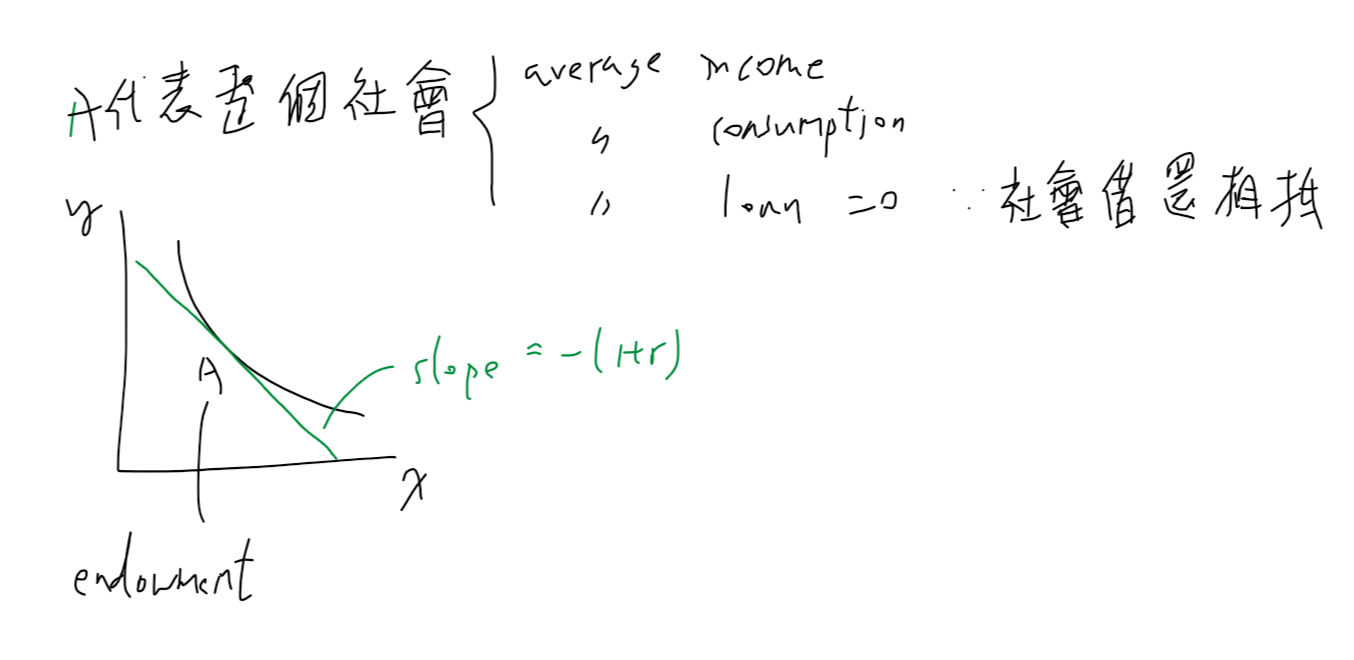

Repesentative Agent¶

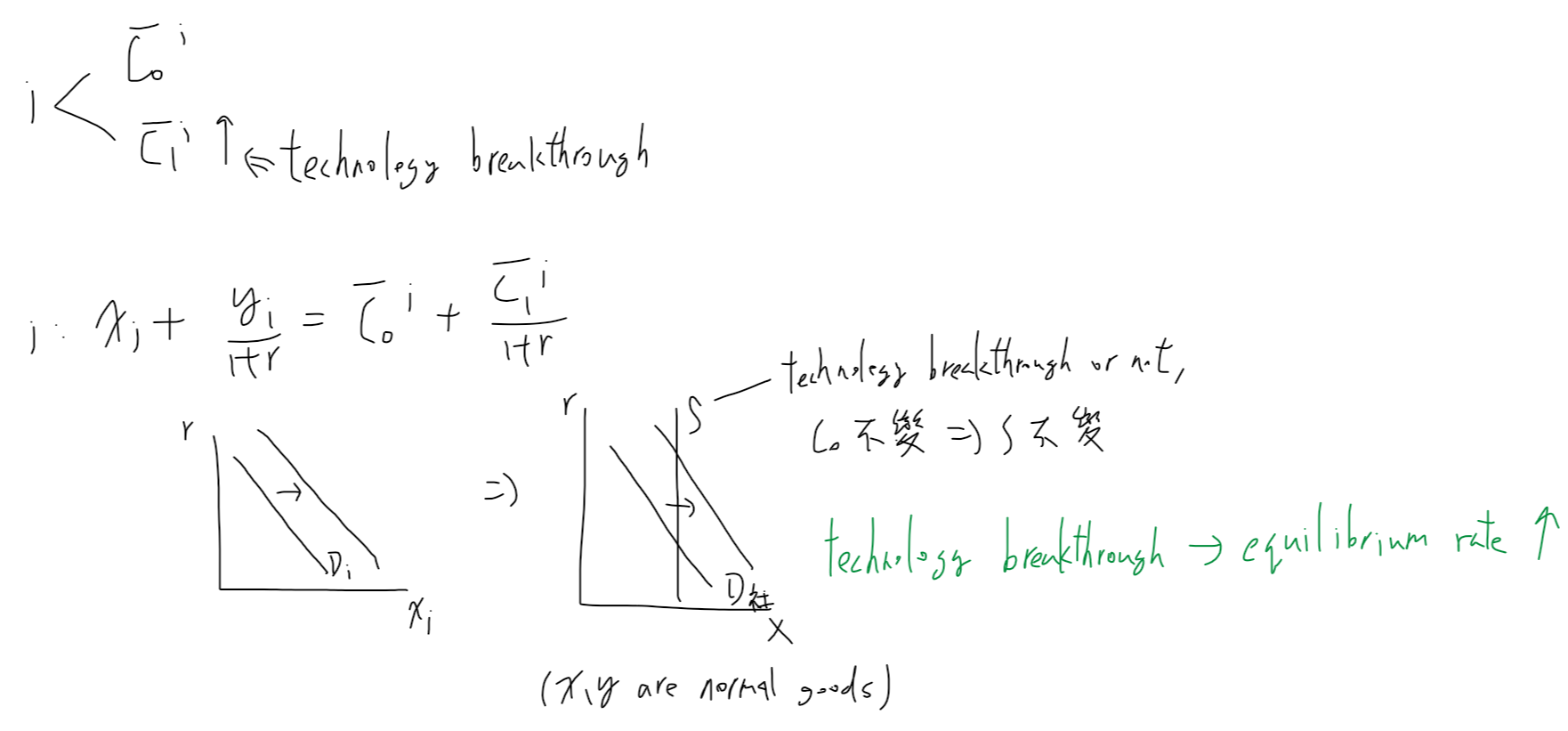

technology breakthrough¶

以傳統模型解釋¶

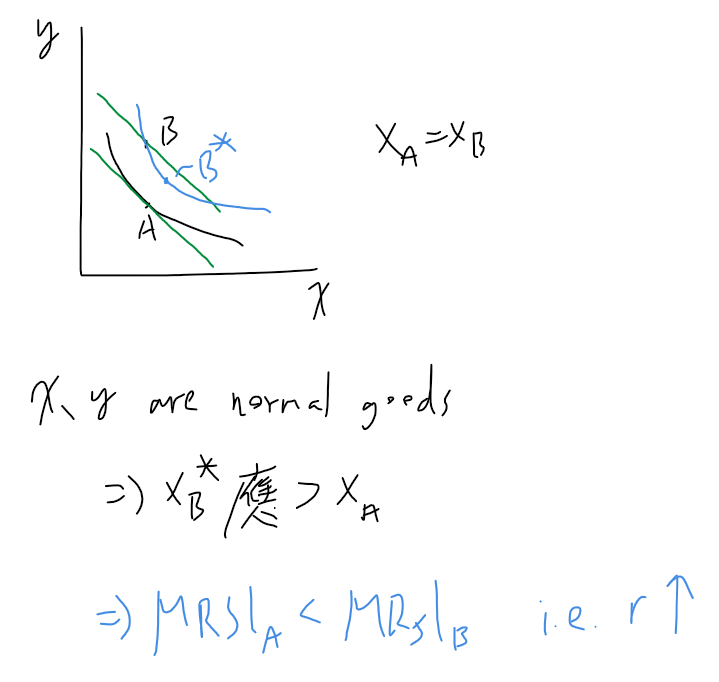

以 Repesentative Agent 解釋¶

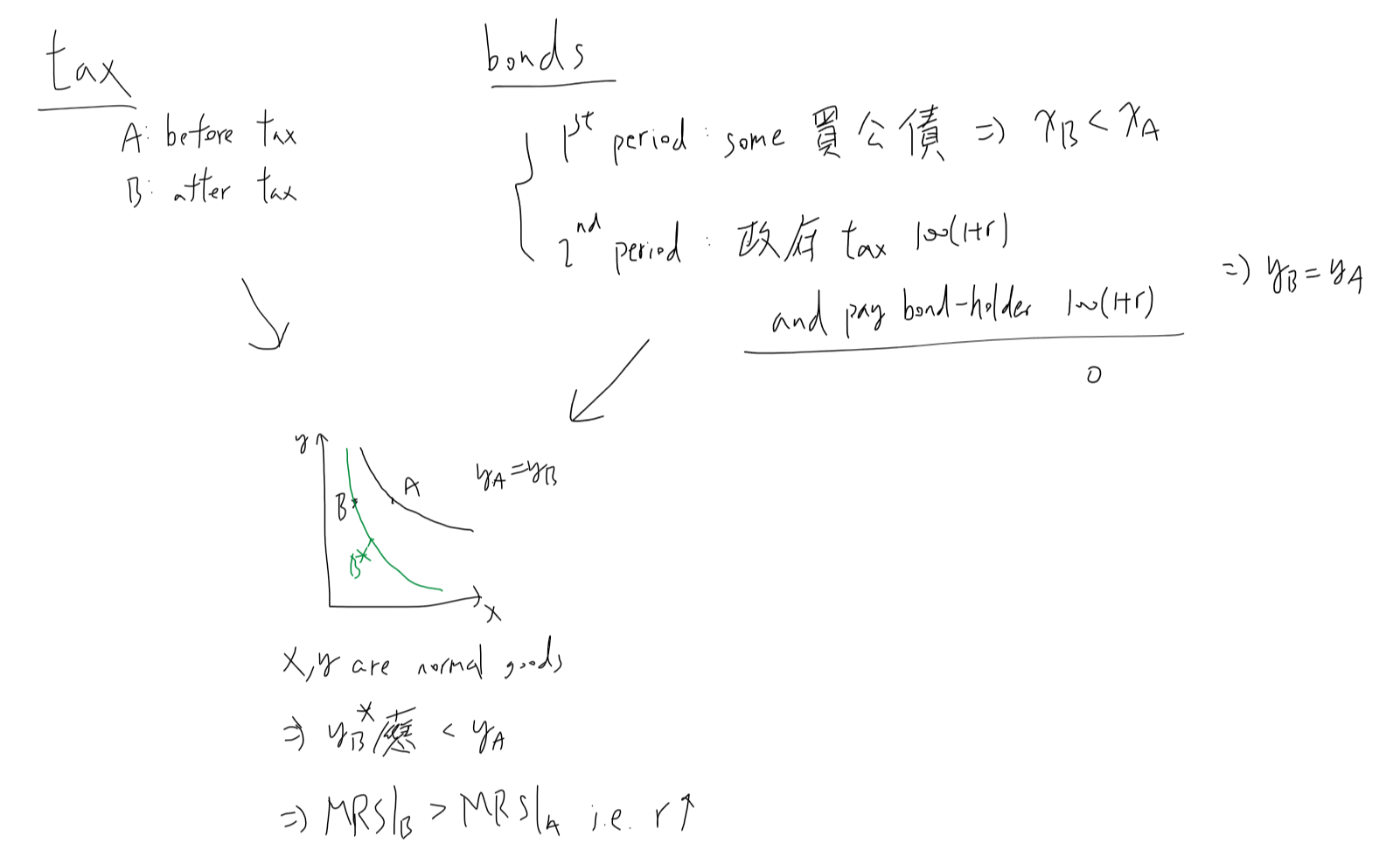

Recardian Equilibrium¶

政府不論用何種方式(稅 or 公債)籌措財源,

政府不論用何種方式(稅 or 公債)籌措財源,

對市場造成的利率上漲幅度是一樣的

HW¶

P6¶

P8¶

可轉售

P15 (You could assume a linear market demand)¶

可參考看看這個 Monopoly and the Rate of Extraction of Exhaustible Resources

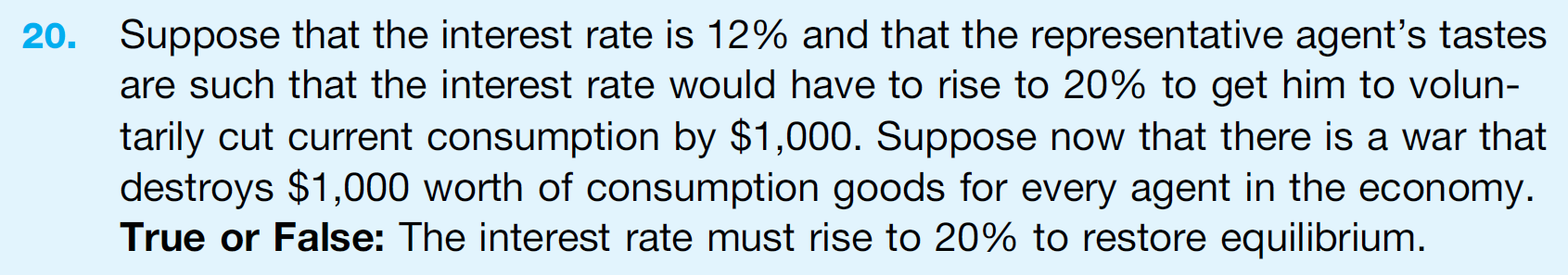

P20¶

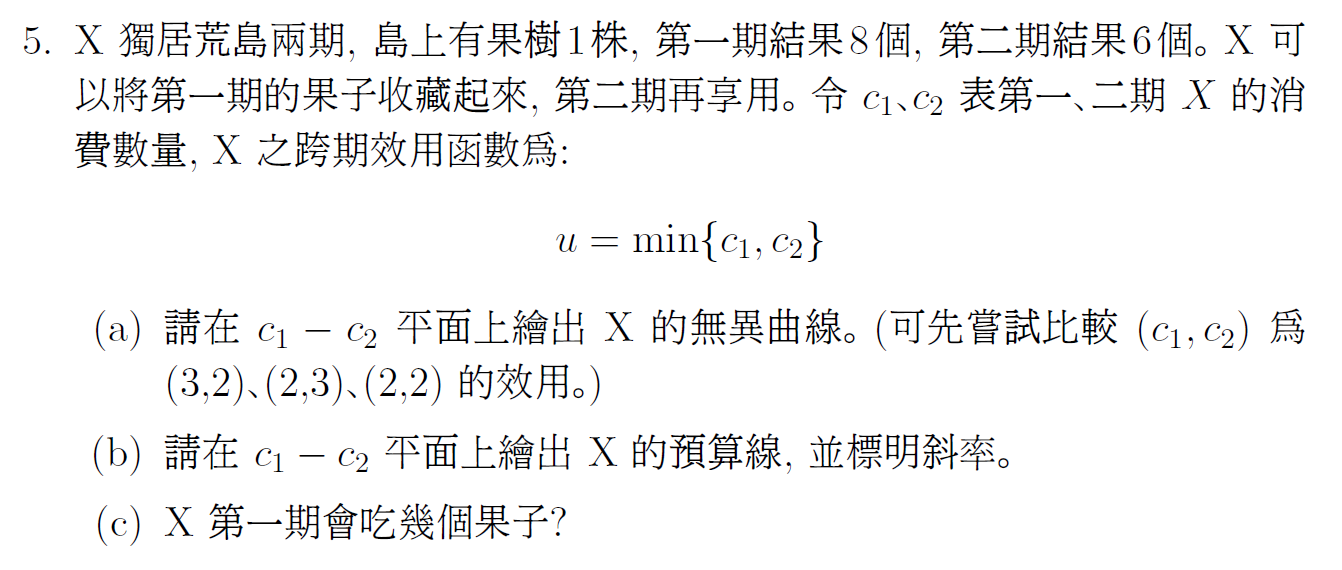

#5¶

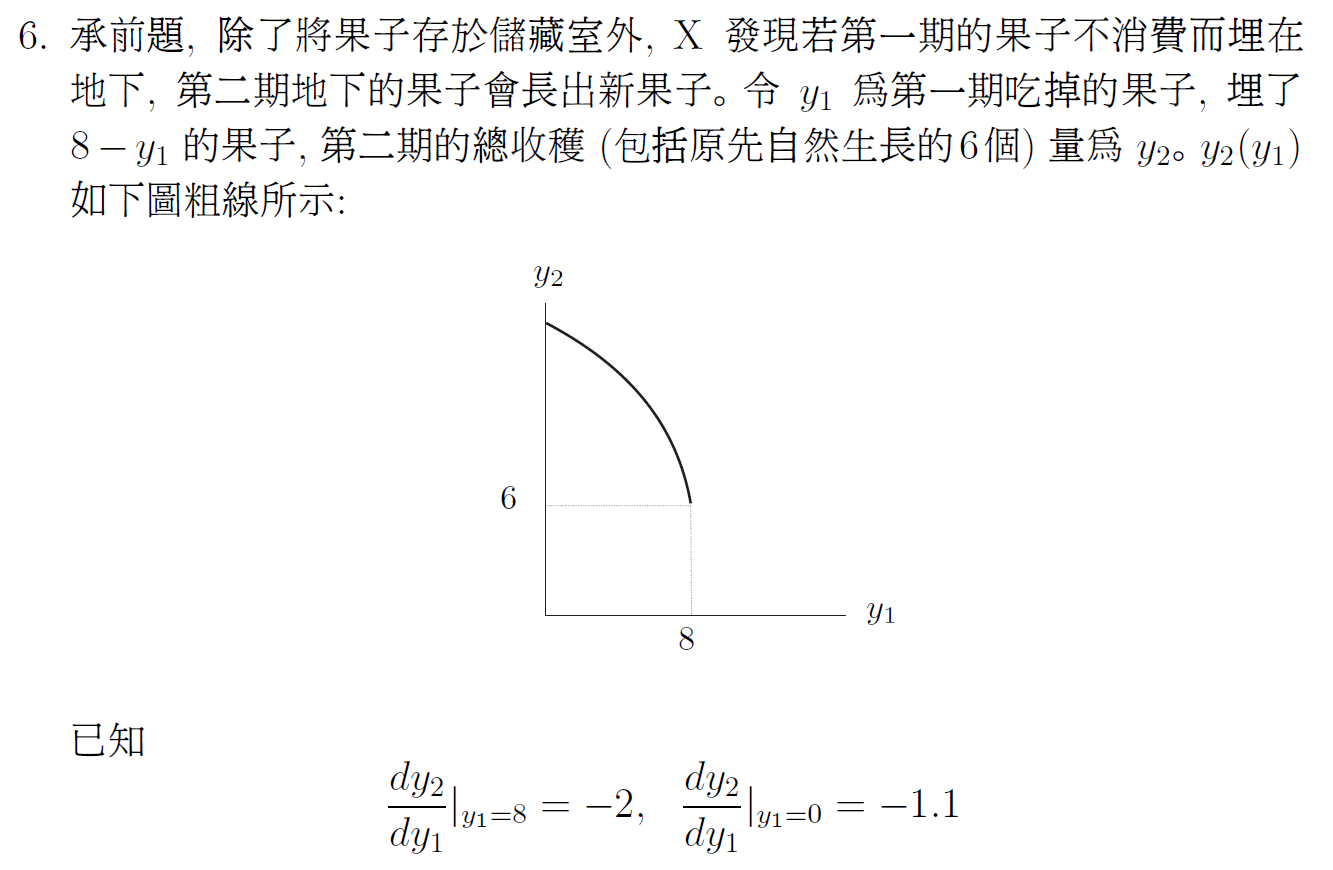

#6¶