Industrial Organization¶

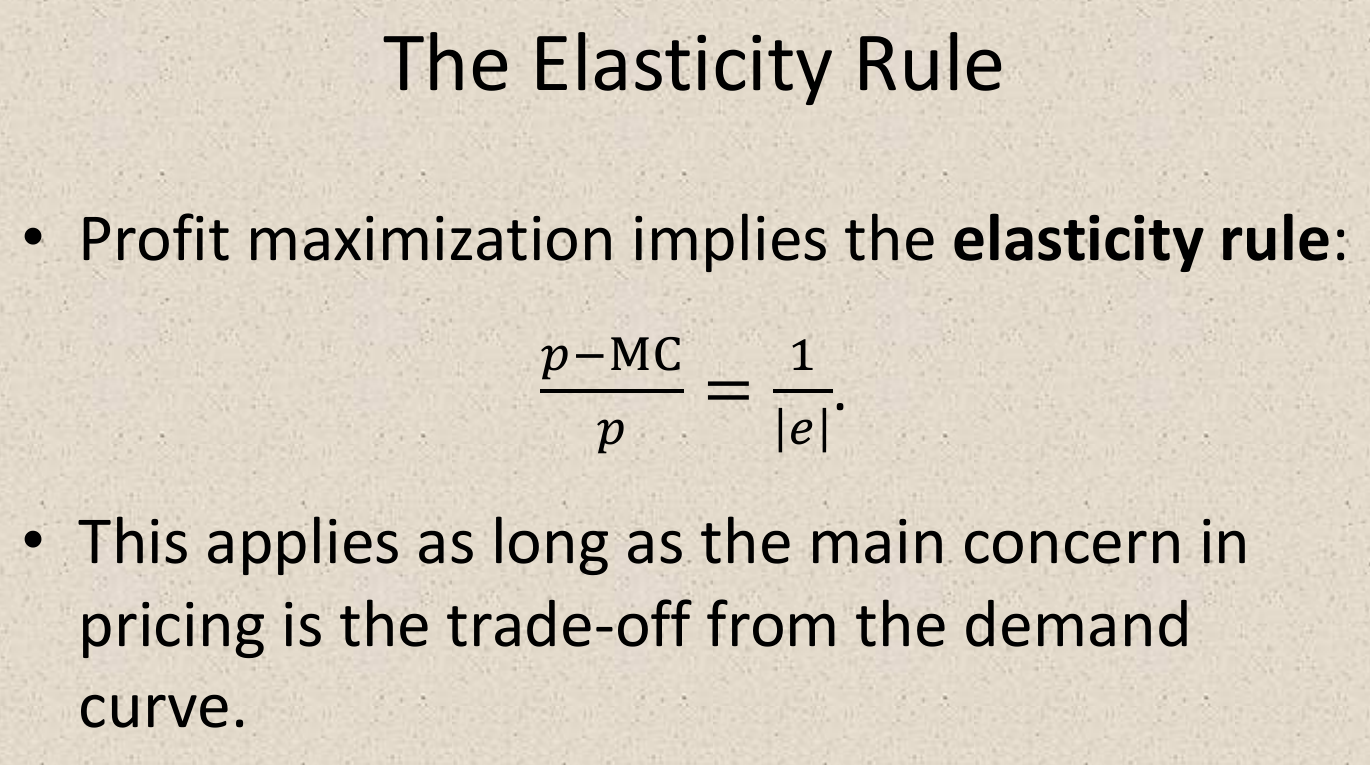

Price Elasticity¶

- \(\Delta R = (p+\Delta p)(q+\Delta q)-pq\)

- \(MR=\dfrac{\Delta R}{\Delta q}=p(1-\dfrac{1}{|e|})\)

- e = elasticity

- MR = MC

- \(\dfrac{p-MC}{p}=\dfrac{1}{|e|}\)

- elasticity of demand

- Products with close substitutes have elastic demand.

- Demand for an individual brand is more elastic than industry aggregate demand.

- Products with less complements have more elastic demand.

- Demand becomes more elastic in the long run.

- As price increases, demand curves become more price elastic.

- markup = \(\dfrac{P-C}{P}\)

- market segmentation limit

- cost of getting everyone's preference profile

- hard to stop resale

Oligopoly¶

see Oligopoly

Bertrand Model¶

- Bertrand Model

- firms set price simultaneosly

- Nash equilibrium of duopoly is both setting competition price -> Bertrand paradox

Cournot Model¶

- Cournot Model

- firms set output simultaneosly

- Nash equilibrium of duopoly

- given \(MC=c, P(Q)=a-bQ, a>c\)

- \(q_1=q_2=\dfrac{a-c}{3b}, P=\dfrac{a+2c}{3}\)

- P & Q between monopoly & competition

- Nash equilibrium of n firms

- given \(MC=c, P(Q)=a-bQ, a>c\)

- \(q_1=q_2=\dfrac{a-c}{(n+1)b}, P=\dfrac{a+nc}{n+1}\)

- \(n \rightarrow \infty\) -> competition

example: linear city with differentiation¶

- a 1-unit long linear street with evenly distributed customers, and 2 firms at each end

- transportation cost per unit distance = t

- equilibrium price = MC+t

- transportation cost can be translated to product differentiation

- with product differentiation, products can sell above competition price even in Bertran model

collusion¶

- market power = \(\dfrac{p-MC}{p}\)

- how much is the firm able to sell above MC

- system profit in Bertrand competition < system profit of monopoly

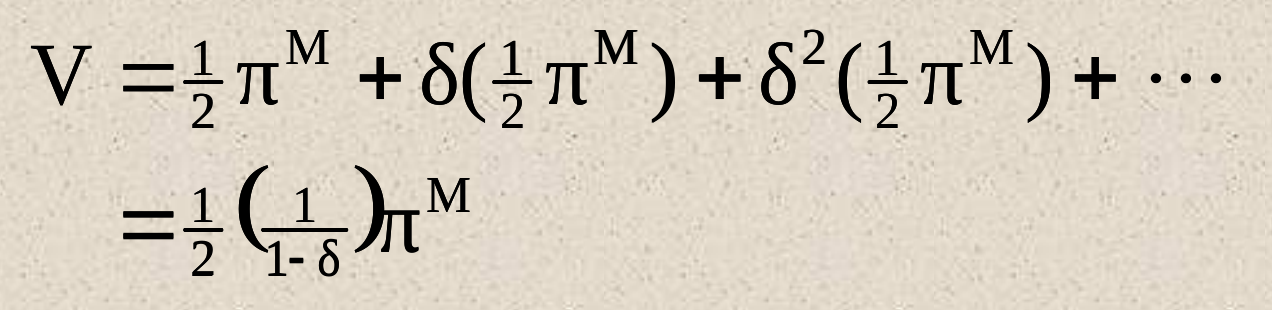

- repeated game

- infinite period

- discount factor \(\delta\)

- 1 in this period -> \(\delta\) in next period

Grim Trigger Strategy¶

- algo

- initially both firms set p = monopoly price

- if history price was always the monopoly price, set p = monopoly price

- else set p = MC

- analysis

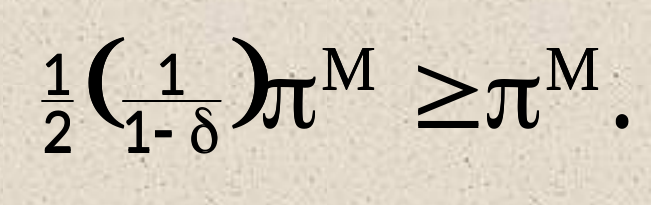

- don't deviate -> share monopoly profit

- deviate -> get all the profit this period

- to deviate

- \(\delta \geq \dfrac{1}{2}\)

final¶

https://hackmd.io/lgE6h18aSzyV4I7PrE0zzg

miscellaneous¶

- gross profit margin vs. operating profit margin

- gross profit = revenue - direct cost of the products sold

- operating profit = revenue - all cost

- https://www.investopedia.com/ask/answers/010815/what-difference-between-gross-profit-margin-and-operating-profit-margin.asp